As stocks and bonds remain vulnerable to gyrations in global markets, one of South Korea’s major pension funds is betting big on alternative assets to boost returns.

Government Employees Pension Service, with about $6 billion in assets, plans to raise its investments in the category, that includes private credit and real estate loans, to 34% in the next four years from about 28% aimed for this year, Chief Investment Officer Baek Joohyun said in an interview.

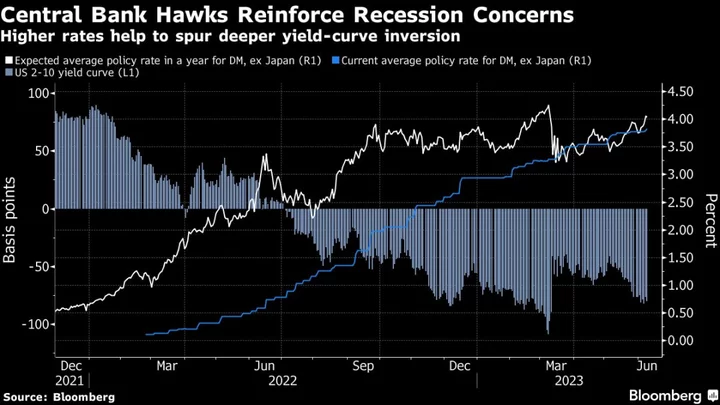

“Stocks and bonds are very volatile, while alternative investments are attractive as a hedge against risk,” said Baek. “It’s a lending-friendly environment,” and private credit offers better risk-adjusted returns in a scenario of high interest rates, he added.

Private lenders — which increasingly include pension and sovereign wealth funds — are benefiting from the higher interest-rate environment and the more fragile confidence in credit markets. Nine out of 10 investors believe the $1.5 trillion market has met or exceeded their expectations over the past year, according to a recent report by Preqin.

The fund’s outstanding positions in private debt stood at 447.1 billion won ($340 million) as of July, and is planning to invest $70 million in overseas real estate loans, which would mark its entry into the global property market. GEPS expects a return of 7-8% from real estate in developed countries, Baek said.

The fund plans to cut its exposure to domestic equities to 12% of its total assets by 2027 from 16.4% this year, and boost overseas investments, mainly in the US, to 18% from 14.6%. It remains bullish on certain sectors, especially chip stocks such as Samsung Electronics Co. locally.

Its bullish wagers on Korean chip and EV stocks helped drive its 16.9% gains from equities during the first half of the year, outperforming the MSCI all country index’s 12.8% gain.

In a wide-ranging interview, Baek also said:

- The fund plans to buy high-quality bonds in parts to secure high-interest rate from a mid to long-term perspective

- The fund reduced its stock exposure to Europe on inflation risks, while increasing to the US on solid corporate earnings and expectations that its economy will have a soft landing

- Among emerging markets, likes India and Vietnam as they will benefit from restructuring of global supply chains

- Remains neutral on China, and expects gains in Chinese stock markets to be limited during the second half of this year, but will continue to monitor the markets for future opportunities as valuations have become attractive

- GEPS reduced exposure to local financial firms and telecom stocks during first half of this year amid wagers of growth slowdown

- Going forward, it sees opportunities in construction, machinery and shipbuilding stocks in South Korea on expected demand from re-construction activity in Ukraine after war and Saudia Arabia’s Neom city project