South Korea priced its first yen bond in Japan, raising 70 billion yen ($474 million) in a move that highlights warming ties between two neighbors with a painful historical legacy.

Investors including Japanese domestic players, Middle Eastern financial firms, global IT companies and international institutions placed bids for the Samurai offering, which officials in Seoul said would deepen financial and economic links between the two countries.

The sovereign’s bellwether sale on Thursday may carve the way for other yen bond sales by South Korean corporates, as the governments cooperate more with the US over North Korea and China. Korean President Yoon Suk Yeol has sought to revamp ties with Japan after relations under his predecessor turned frosty and disputes surrounding Japan’s colonial rule of the Korean peninsula flared.

“There are economic and political incentives for both parties in this deal, with South Korea able to fund cheaply in yen and leaders of both countries working to improve relations,” said Takao Sasaki, a professor of political science at Heisei International University.

Leaders of the two countries held the first formal summit since 2011 on Japanese soil this year, reinstated South Korea as one of Japan’s preferred trading partners and agreed to restore a foreign currency swap arrangement worth as much as $10 billion.

The Korean sovereign’s credit rating is higher than Japan’s, and its debt sale in Japan on Thursday is the biggest by a Korean issuer in the Samurai market since early 2019, according to data compiled by Bloomberg.

The focus of the transaction was to diversify foreign exchange reserves and take advantage of the low cost of borrowing in yen, according to a Korean finance ministry statement released after the deal concluded.

The three-year tranche priced at 23 basis points over the benchmark. That’s one of the tightest spreads for any issuer in the market in recent years, according to data compiled by Bloomberg.

“The issuance offers geographical and sector diversification and stable credit quality, and is certainly a plus,” said Haruyasu Kato, a fund manager at Asset Management One. “We limited our investment to shorter-duration notes due to uncertainty about domestic and foreign monetary policy.”

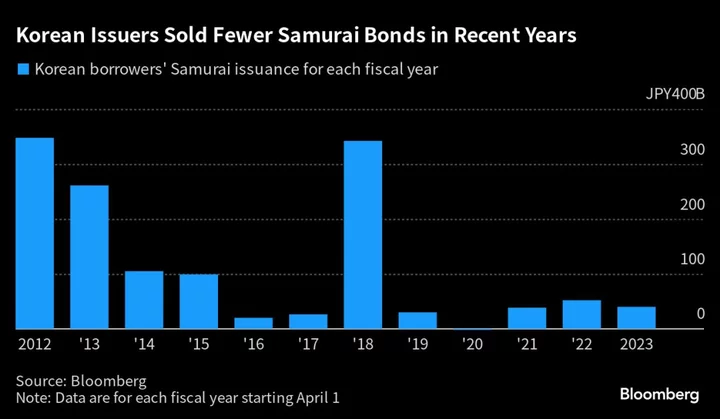

Korean corporate issuers are no strangers to the Samurai market, but bond sales have tended to wax and wane depending on political relations between the nations.

The last time Korean companies led sales in the Samurai market was in the fiscal year beginning April 1, 2012, but their offerings have been smaller than those from most global peers in recent years, according to data compiled by Bloomberg.

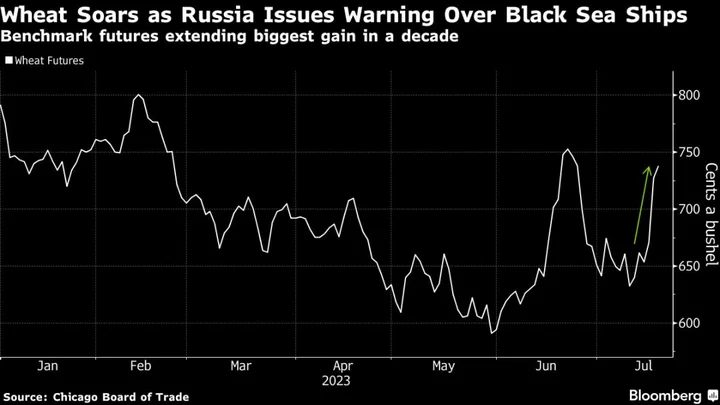

Samurai bond sales had climbed 57% to 845 billion yen since the start of the fiscal year in April to Wednesday versus the same period last year, according to data compiled by Bloomberg. Yields on yen corporate bonds average about 0.8%, making them cheaper for high-grade borrowers compared with the US market, where they’re around 5.8%, the data show.

The Korean government bond sale adds to a growing number of sovereigns raising funds in the Samurai market in recent years. Indonesia issued yen notes this year, while the Philippines, Mexico, Hungary and Egypt did deals in 2022.

--With assistance from Ayai Tomisawa, Shintaro Inkyo, Shinhye Kang and Issei Hazama.

(Updates with comment from Korean government, investor quote throughout)

Author: Finbarr Flynn, Daedo Kim and Takahiko Hyuga