Laurentian Bank of Canada is still conducting a strategic review that could lead to a sale, but the lender gave investors no update or timeline as it reported earnings Thursday. The shares fell 3.6%.

Chief Executive Officer Rania Llewellyn declined to answer analysts’ questions about the process, which was announced July 11. Canada’s ninth-largest domestic bank by market value has been working on a turnaround since 2020 under Llewellyn, a former Bank of Nova Scotia executive and the first woman to lead a publicly traded Canadian bank.

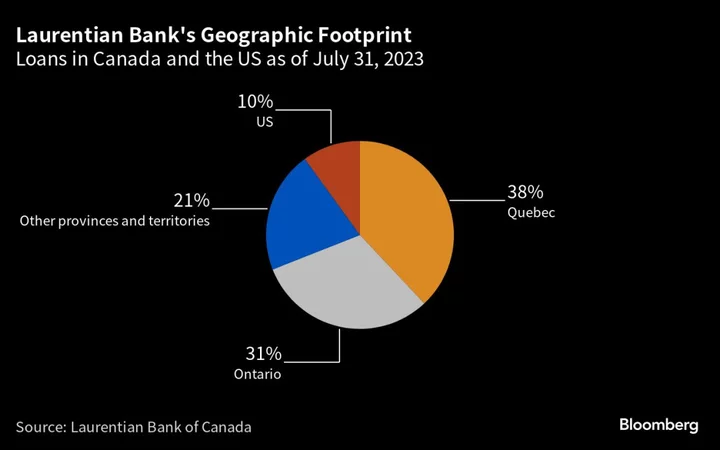

National Bank of Canada analyst Gabriel Dechaine said the sale appears to be “more complicated than anticipated” for Laurentian. The bank has a US subsidiary, Northpoint Commercial Finance, that specializes in lending for recreational products such as boats and ATVs.

It’s Laurentian’s fastest growing segment, but Northpoint would be an “awkward fit” for Canadian banks more interested in its Quebec-focused operations, Dechaine wrote. That suggests the bank might be divided and sold to multiple buyers, he added. It’s also possible the bank will decide not to do a deal at all.

Shares of Laurentian closed Thursday at C$36.75, well below its book value of C$59.30 per share.

Last month, the Globe and Mail reported that Scotiabank and Toronto-Dominion Bank withdrew from the list of potential bidders. Several analysts had seen them as top contenders to acquire Laurentian. Scotiabank executives have said they want to expand in the French-speaking province of Quebec, while Toronto-Dominion sits on pile of excess capital since its failed attempt to buy First Horizon Corp.

Among Canada’s Big Six banks, Montreal-based National Bank is also seen as a possible suitor for Laurentian. Nigel D’Souza, an analyst with Veritas Investment Research, said in a July report that the National was the “best fit” for Laurentian, but that it would likely need to raise capital to fund any deal given regulatory capital requirements.

Read More: National Bank Grows Tech Book With SVB’s Canadian Portfolio

“We like our strategic focus on growing our Canadian franchise,” National Bank CEO Laurent Ferreira said in a conference call Wednesday. “Our capital levels are higher than peers at this point in time on average. We’re comfortable operating at that level given the uncertainty.”

Laurentian reported adjusted earnings per share of C$1.22 for the quarter ended July 31, beating the average analyst estimate of C$1.16. Adjusted net income was C$57.6 million, down about 1% from the same period a year earlier.

The bank’s provision for credit losses was down 20% at C$13.3 million.

(Updates share price, adds comments from analyst beginning in the third paragraph)