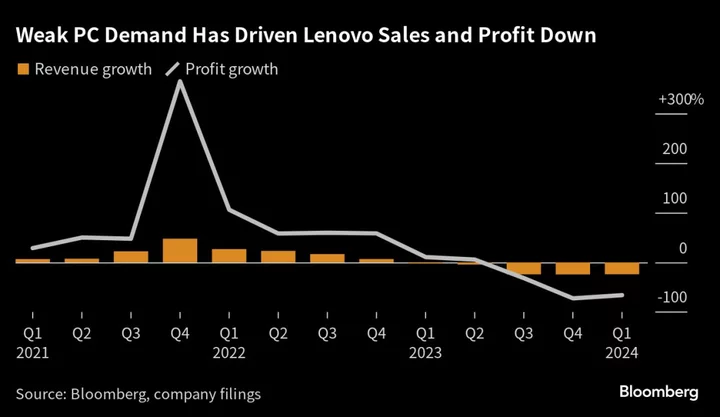

Lenovo Group Ltd.’s profit missed estimates for a second straight quarter after the global PC market slid deeper into a demand slump.

The world’s biggest PC maker reported net income fell 66% to $176.5 million in the three months ended June, compared with the average analyst estimate of $235 million. Revenue also declined and didn’t meet consensus expectations, at $12.9 billion, according to a company filing on Thursday.

Shares fell as much as 6.1%, their biggest intraday drop in nearly three months, after the results were released.

Lenovo fended off HP Inc. to keep the top position in global PCs during the past quarter but also saw shipments shrink 18.4%, according to IDC. The company said the unusual action of clearing inventory weakened profitability for its main business unit. Chinese consumers are increasingly reluctant to buy smartphones, laptops and other devices as the world’s second-largest economy slides into deflation.

“The intelligent devices group, which sells PC and smartphones and is the biggest source of revenue, is poised to be the main drag due to sluggish consumer demand and ongoing inventory digestion,” Bloomberg Intelligence analyst Steven Tseng wrote in a memo before results were released.

Uncertainties in the timing of a recovery in demand for PCs and storage gear could further cloud Lenovo’s business prospects, Goldman Sachs analysts Verena Jeng and Allen Chang wrote in a note ahead of the earnings release. Fiercer-than-expected competition in smartphones and AI servers could also weigh on the company.

On the bright side, a demand surge for AI servers could kickstart another round of growth for Lenovo. The Beijing-based company introduced a server brand tailored for the Chinese market, where a slew of local companies from Baidu Inc. to SenseTime Group Inc. are developing ChatGPT-like AI services. The company sees the rapid development of AI applications generating numerous new opportunities, it said in its statement.

“AI’s higher requirements of computing power and new AI functions will support demand for Lenovo’s end devices,” the Goldman analysts said. “In overseas market, Lenovo is well positioned with global leading clients and for overall servers business, we expect Lenovo to grow on market share gain, product mix upgrade and product lines expansion.”

--With assistance from Mayumi Negishi.

(Updates with share price drop and growth chart)