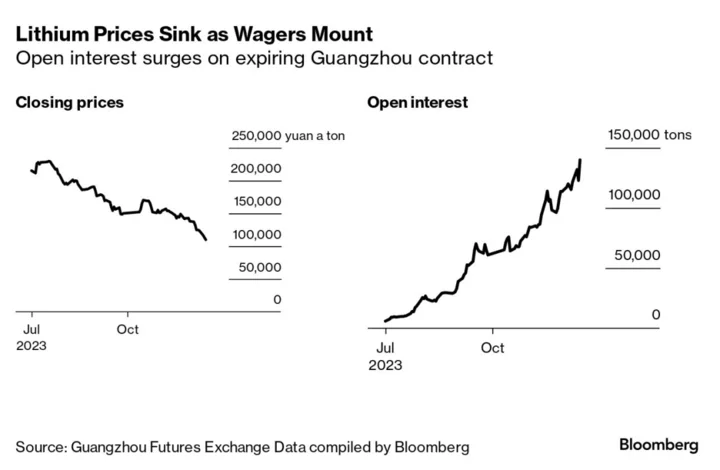

The swift and brutal decline in lithium prices may still have room to run as bearish bets mount on the Chinese futures market that trades the battery metal.

Prices on the Guangzhou Futures Exchange have more than halved since the bourse debuted lithium trading in July as supply overwhelms demand. The market is now approaching its first contract expiry in January, and the number of trades that need to be settled via the physical delivery of the metal has exploded higher.

In one corner, traders with long positions — wagers that prices will rise — are debating whether to throw in the towel and sell. In the other, short-holders are tempted to add to their positions in the belief that prices will drop further. But the latter camp risk a classic short squeeze if they get their assumptions wrong and are forced to buy lithium in a rising market to close out their positions.

“All the market attention and capital are on the January contract, and these two to three weeks may be the final battle,” said Susan Zou, an analyst at Rystad Energy in Shanghai. “Some long positions may be struggling already, and need to close their holdings to minimize losses.”

China has added futures trading for lithium carbonate, a refined form of the metal, in a bid to better influence the price of a key material for its world-beating electric vehicles industry. The Guangzhou exchange now trades more of the battery metal than its rivals in more established commodity hubs like Chicago, London and Singapore. Its January contract expires on Jan. 16.

The drama and price volatility that has accompanied Guangzhou’s ascent are a reminder of the difficulties in forecasting the trajectory of new, fast-growing markets. With both supply and demand for battery metals rising at breakneck pace, and technology constantly evolving around cell design and development, predicting the industry’s future is proving a challenge.

After rallying for two years to a record high in 2022, lithium prices have collapsed, battered by a supply glut and disappointing demand growth for batteries. Higher interest rates have cast a pall over global EV sales, forcing some automakers to rethink their strategies. The lithium market won’t return to a deficit until 2028, according to consultancy Benchmark Mineral Intelligence.

“The recent price plunge is mainly driven by weak market sentiment and pessimistic forecasts of the lithium market balance,” said Xiaowei Mei, an analyst at CRU Group. Many traders aren’t sold on the idea that a squeeze is imminent and they’re continuing to build short positions despite the approaching expiry, she said.

Still, the Guangzhou exchange is “making an effort to minimize the risk of a short squeeze,” Mei said. It has authorized more warehouses to take physical delivery of lithium, adding the depots of Tianqi Lithium Corp., Sinotrans Ltd. and others to its list on Monday, to widen the availability of the metal. If the January contract sees a disruptive expiry and prices whip higher, it could damage the bourse’s standing as an orderly venue for trading.

In any case, the bears seem to be in control. “Against the backdrop of weak fundamentals, short positions are still dominant,” said Zhang Weixin, an analyst at China Futures Co. “There’s still room for contract prices to drop before January’s delivery.”

The Week’s Diary

Thursday, Nov. 30:

- China’s official PMIs for November, 09:30

Friday, Dec. 1:

- Caixin’s China factory PMI for November, 09:45

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

On the Wire

China’s President Xi Jinping visited Shanghai for the first time in three years, putting a spotlight on the mainland’s top financial center as investors look for policymakers to boost waning private sector sentiment and the technology sector.