Sephora, the cosmetics retailer owned by luxury conglomerate LVMH, is considering an overhaul of its China operations, including seeking a new leader for the country, as it works toward delivering an ambitious sales target for the coming years.

The beauty retailer is looking to pick a new China head as soon as this year and is also considering improving VIP services for its premium customers, people familiar with the matter said, asking not to be identified discussing the group’s private deliberations.

Read more: Harrods to Open First Private China Club Catering to Ultra-Rich

Sephora is on track for worldwide revenue of €13 billion ($15 billion) this year, the people said. Yet growth in China has been sluggish due to intense competition in the country’s cosmetics sector, and senior managers are looking to install a new executive to lead the next growth phase. They view the market’s immense business potential as core to hitting a target of €20 billion in annual global sales in about five years, according to the people.

A representative for Sephora declined to comment while parent company LVMH didn’t immediately reply when asked to comment.

Read more: China’s Big-Spending, Picky Youth Are Global Luxury’s Lifeline

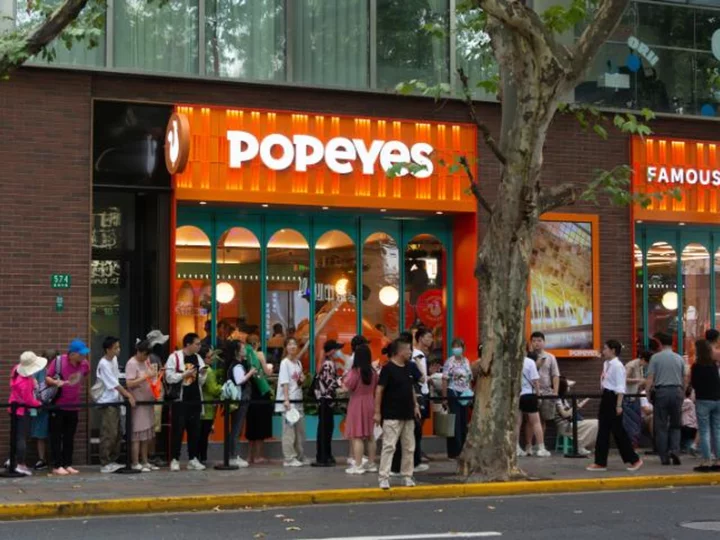

LVMH Moet Hennessy Louis Vuitton SE, the luxury empire of billionaire Bernard Arnault, is doubling down on China — already a critical driver of growth for the luxury sector and a market expected to surpass both the US and Europe to be the world’s biggest by 2025. With an increasing number of Chinese consumers preferring to stay home and shop domestically post Covid, many foreign firms are looking to boost their presence in the country.

LVMH has already moved some brands’ regional headquarters and senior executives to mainland China, while Arnault visited the country last month for the first time since Covid lockdowns eased to tour stores and meet with local teams.

Sephora is estimated to have generated €11.6 billion in sales last year, making it LVMH’s second largest brand after Louis Vuitton, though it ranked fifth in profitability, according to an April report by HSBC Holdings Plc.

Intense Competition

Unlike luxury fashion houses Louis Vuitton and Christian Dior, Sephora hasn’t yet established itself as a go-to choice for Chinese consumers despite having opened more than 300 stores in about 90 cities and selling on popular e-commerce platforms.

Competition is intense in China’s $88 billion beauty and personal care market. While major global beauty groups like L’Oreal SA and Estee Lauder Cos. are expanding their presence, popular domestic brands like Florasis and Perfect Diary have won market share due to rising consumer nationalism and sales strategies that better target local shoppers.

Sephora is testing new sales tactics to differentiate from its rivals, such as offering niche overseas beauty brands that consumers can’t easily find online and featuring more Chinese brands on its shelves.