Investors have shown few signs of panic during a stock market slump that’s pushed the S&P 500 Index into its first losing quarter in a year. But beneath the surface, signs of stress are emerging that go far beyond the just averted US government shutdown.

It’s not the intensity of the drop that’s weighing on sentiment, but rather the fact that big down days are getting more frequent and there’s been a scarcity of large rebounds. Three of the six days when the S&P 500 lost more than 1% last quarter occurred since mid-September. And there were only two days when the index gained more than 1% in the quarter. That down-to-up ratio of three is the highest since 1994, data compiled by Bloomberg show.

For those hoping for an imminent reprieve, options traders have a message: Don’t get too comfortable just yet. A gauge of expected price swings in the S&P 500 Index over the next week is hovering above the expected volatility two months from now, the opposite of a normal pattern when risks are seen rising with time.

It’s easy to see why traders would be nervous heading into this week with the specter of the narrowly-averted US government shutdown hovering over their heads. In addition, the yield on the 10-year Treasury note is hanging around its highest level in almost 16 years, sapping the appeal of riskier assets. Then there’s the question of how far the Federal Reserve is willing to go to combat inflation. And a worsening auto-worker strike only adds to the risk of wider price swings ahead.

“We just have a lot of questions that are on people’s minds,” said Brian Donlin, an equity derivatives strategist at Stifel Nicolaus & Co. “You’ve seen a bit more hedging, a bit more risk of a real vol spike.”

Trading has remained orderly and few signs of panic-hedging were around during a drop of four straight weeks in the S&P 500 — the longest streak this year — that’s knocked off more than 5% from the gauge. Still, signs show traders are bracing for volatility to linger.

The price of a so-called straddle strategy — a bet on wider price swings using puts and calls of the same strike price and expiration — is now higher than the average two-month reading for a number of US-focused exchange-traded funds, according to Stifel data as of late September.

Count IUR Capital’s Gareth Ryan among those riding the wave of volatility. A day after the Fed reiterated its higher-for-longer stance, the firm’s managing director bought a put spread on the SPDR S&P 500 ETF Trust, wagering that stocks would fall and volatility rise. He trimmed some of that wager when the S&P bounced on Thursday. The VIX Index is at 17.52, above its close of 14.11 the evening before the rate-decision day.

To be sure, that level still gives off few signs of fear. And at least one attribute of panic selling — synchronous share-price swings — is nowhere to be seen. Realized one-month correlation among S&P 500 stocks is hovering at 0.24, down from a reading of 0.29 in late August despite a broad stock-market decline during that time. A rotation out of the likes of tech and into energy has likely kept correlations in check.

“While investor anxiety may be rising, it is likely only doing so moderately and doesn’t feel like a panic,” said Bram Kaplan, head of Americas equity-derivatives strategy at JPMorgan Chase & Co. “The rise in volatility is only moderate. There hasn’t been a surge in option volatility skew or the put/call ratio to indicate a scramble for hedges.”

Still, the latter part of September didn’t look good for equity bulls. Rising rate anxiety has likely weighed on sentiment. Also, share buybacks have been frozen for about 90% of S&P 500 firms amid a pre-earnings blackout, stripping the stock market of a big upward influence.

A widening strike by the United Auto Workers union against Detroit’s Big Three carmakers and the prospect of a government shutdown only added to the near-term uncertainty.

Hence the move in implied volatility for at-the-money S&P 500 options expiring in five days. At one point last week, they hovered 0.7 points higher than a gauge of expected price swings two month from now, the widest spread since the banking crisis in March.

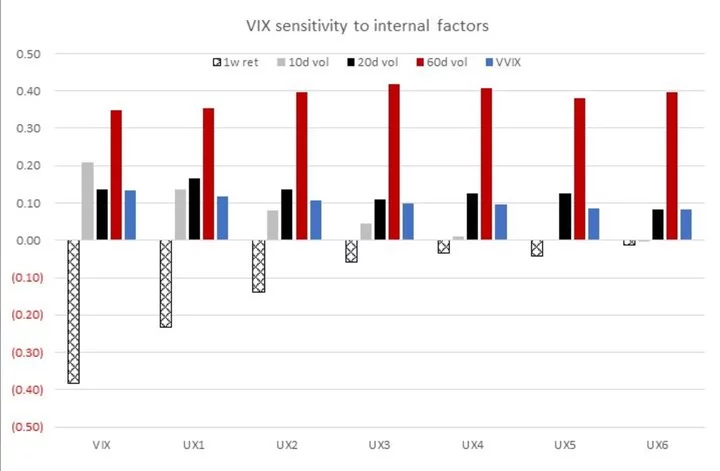

The past couple of days have seen their fair share of volatility, and short-term options — which are more sensitive to such moves than the longer-dated contracts — were quick to react. Data compiled by Citigroup Inc.’s Stuart Kaiser illustrates just how more sensitive the VIX Index is to short-term moves in the S&P 500 Index and the S&P 500’s realized price swings than the volatility curve further out in time.

“The period of anxious but not delirious markets continues,” Kaiser said. “We estimate the front of the VIX curve right in-line with market internals but room for futures to shift higher in a prolonged period of stress.”

--With assistance from Brad Skillman.