A look at the day ahead in U.S. and global markets from Mike Dolan

If investors were wondering why Federal Reserve rhetoric remains so doggedly hawkish, the latest U.S. consumer price inflation report on Tuesday will likely explain why.

According to consensus forecasts at least, U.S. headline inflation is expected to have retreated sharply again in October back toward midyear lows around 3.3%. A near 15% drop in retail gasoline prices since late September should help see to that.

But underlying 'core' inflation is expected to stay stickier at an unchanged annual rate of 4.1% last month and still more than twice the Fed's target.

There's been more encouraging news on inflation expectations, however, with the New York Fed's latest survey of household sentiment showing a one-year inflation outlook slipping to 3.6% last month and as low as 2.7% over five years.

But the Fed may want to hang tough long enough into a slowing economy to ensure that inflation is squeezed back to its 2% goal. Goldman Sachs, for example, reckons the hard part of the Fed's fight is over but it may not start cutting rates until the fourth quarter of 2024.

Futures markets are still more optimistic - seeing the first quarter-point cut fully priced by July and 75 basis points of easing in total in the mix by the end of next year. The worrying state of U.S. small businesses will be seen in the NFIB report for October out later today.

Long-term investors think the Fed is just playing a holding game and ultimately the cooling economy will allow it to ease enough to make today's juicy bond yields worth snapping up.

Bank of America's latest monthly funds survey shows global asset managers holding their biggest overweight position in bonds since March 2009 - and some 61% think yields will be lower in 12 months' time than they are now.

And perhaps the negative tilt on October core inflation going into today's release leaves more room for a positive surprise. Ten-year U.S. Treasury yields hovered just above 4.60%, the dollar index was a touch softer and S&P500 futures were marginally positive ahead of the bell.

Although U.S. crude oil prices have backed up again in recent days, they remain 18% below September's peak and year-on-year losses are running at almost 10%.

The global demand picture remains hard to parse.

The International Energy Agency on Tuesday raised its oil demand growth forecasts for this year and next despite the weakening economic picture.

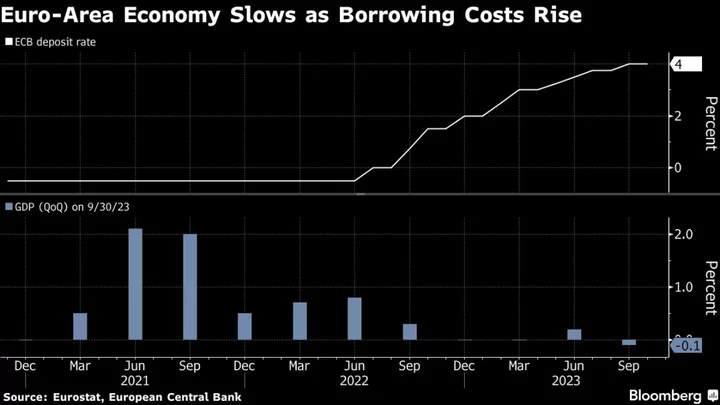

The euro zone economy contracted 0.1% as expected in the third quarter, meantime, raising the prospects of a technical yearend recession and contrasting with the U.S. boom during the same quarter. However, the data wasn't all bad and employment continued to increase in the bloc in Q3.

Elsewhere, the focus shifts to California as China's President Xi Jinping starts his first U.S. visit since 2017 ahead of Wednesday's summit with President Joe Biden in San Francisco during the Asia-Pacific Economic Cooperation gathering there this week.

The White House said on Monday that Biden and Xi will discuss strengthening communication and managing competition.

In the background for XI is the country's ongoing property sector and local debt concerns. Reuters reported on Tuesday that China has ordered its local governments to halt public-private partnership projects identified as "problematic" and replaced a 10% budget spending allowance for these ventures with a vetting mechanism as it tries to curb municipal debt risks.

In Japan, the yen continued to stalk 33-year lows set in October last year at 151.94 per dollar - with markets wary of Bank of Japan intervention should it plunge through there. Japan's Finance Minister Shunichi Suzuki said the government would take all necessary steps to respond to currency moves, repeating his mantra that excessive swings were undesirable.

In corporate news, Home Depot reports earnings in a big week for U.S. retailers.

In deals, Glencore sealed a deal for a 77% stake in Canadian miner Teck Resources' steelmaking coal business for $6.93 billion in cash, paving the way for a spin-off of the commodity giant's own coal business.

Key developments that should provide more direction to U.S. markets later on Tuesday:

* U.S. Oct consumer price inflation, NFIB Oct small business survey

* Federal Reserve Vice Chair Philip Jefferson, Cleveland Fed President Loretta Mester and Chicago Fed chief Austan Goolsbee all speak; Fed Vice Chair for Supervision Michael Barr testifies before Senate Committee on Banking, Housing and Urban Affairs; Bank of England Chief Economist Huw Pill speaks

* China's President Xi Jinping starts visit to United States

* U.S. corporate earnings: Home Depot

(By Mike Dolan, editing by Christina Fincher, mike.dolan@thomsonreuters.com. Twitter: @reutersMikeD)