Memecoins such as Pepe and the recently minted token Ordinals led cryptocurrency prices lower after a weekend surge among the Bitcoin-blockchain-based tokens.

Pepe, a frog-themed coin had jumped more than 3,000% since it was launched in April, fell about 40% on Monday, according to data compiled by CoinGecko. It trades at a fraction of one cent. The token known as Ordi, which debuted this weekend and saw its market value climb to as much as $900 million, dropped a similar amount, CoinGecko data shows.

“Looks like meme season has come to an abrupt end,” said Mati Greenspan, chief executive officer of Quantum Economics. It “was fun while it lasted. But coins without utility can only go so far on hype alone.”

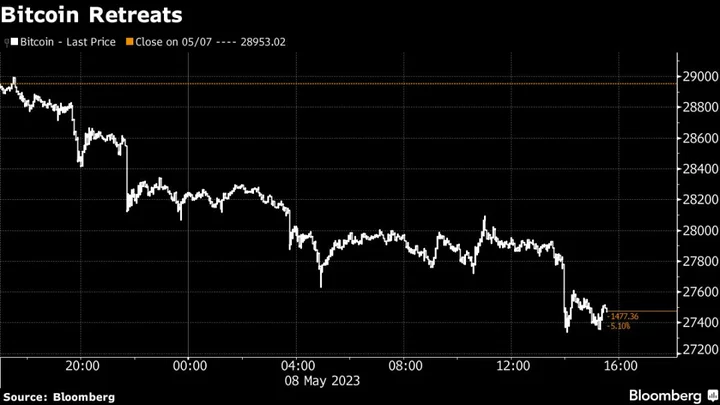

Bitcoin, which accounts for about half of the overall crypto universe with a market capitalization of around $530 billion, fell as much as 5.6% to $27,340 as of 3:24 p.m. in New York. Solana, Avalanche and Polygon all slipped around 9%, while Binance Coin fell 3% and Ether dropped 5%.

Binance, the largest crypto trading platform, halted withdrawals of Bitcoin twice in less than 12 hours on Sunday, citing congestion on the network. The exchange, which is embroiled in a fight with US regulators, said higher fees have been applied to pending transactions so they get picked up by Bitcoin miners — the computer rigs that operate the network. The Bitcoin offshoots are known as BRC-20 tokens.

Memecoins such as Pepe have surged in recent weeks as traders sought to capitalize on the massive price moves the most speculative coins often produce. Bitcoin transaction fees rose to around $19 on average Monday because of the increased trading of the memecoin on the original blockchain, up from about $2 over the past month, according to data provider YCharts.

Until recently, memecoins and NFT collections such as Bored Apes and CryptoPunks were predominately based on Ethereum and served as a catalyst that helped to make that platform the world’s most commercially important blockchain.