The implied chance of Microsoft Corp.’s takeover of Activision Blizzard Inc. going through jumped to around 80% from less than 40% a day earlier after a US judge gave the deal a green light.

The market is now pricing in much higher odds of a deal being completed, assuming the stock’s standalone value without a deal is in the $75 to $80 range, according to Aaron Glick, a merger arbitrage specialist at TD Cowen.

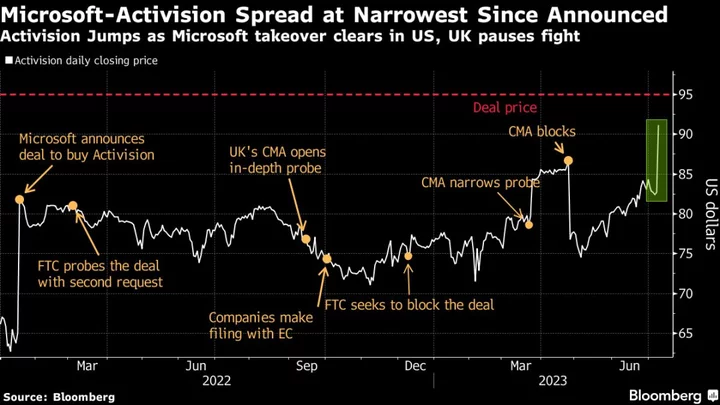

Shares in the video-game company rose 11% to around $91, putting its gap with Microsoft’s $95-a-share offer at about $4, compared with $12.70 at the end of trading Monday. Investors are clearly more encouraged about the deal’s path to closing after the court’s ruling, which also prompted UK regulators to pause their litigation over the $69 billion takeover.

Read: Microsoft Cleared to Buy Activision in US as UK Pauses Fight

“With the companies and the UK antitrust regulator seeking to work on a resolution, closing by the July 18 deal deadline is much more likely now,” said Glick. Most arbs were previously skeptical that Microsoft would be able to resolve the UK challenge, he noted.

Since the deal was announced in early 2022, the spread has fluctuated alongside regulatory updates, with shares sinking to almost $70 in November before gradually climbing back.

Still, Activision remains one of the most popular positions for merger arbitragers, attracting bets from experienced players like Warren Buffett’s Berkshire Hathaway Inc. and Pentwater Capital. Some traders even packed into the San Francisco courtroom last month to follow the hearing. By the end, a consensus emerged that the US Federal Trade Commission was unlikely to be able to pause the deal.

The US clearance, and more importantly the news from the UK Competition and Markets Authority, has changed perceptions dramatically, said Cabot Henderson, who focuses on arbitrage and special situations at JonesTrading.

“Before the market saw the deal as a tossup,” he said. “It would now be a surprise were it not to close.”