US equities are tracking the same path they did in 2019, which was one of the best years for the S&P 500 over the past decade as it handed investors a 29% return, according to Morgan Stanley’s staunch bear, Michael Wilson.

“The data we have today suggests to us that we are in a policy-driven, late-cycle rally,” Wilson wrote in a note. The latest example of such a period occurred in 2019 when the Federal Reserve paused and then cut rates and its balance sheet expanded toward the end of the year.

“These developments fostered a robust rally in equities that was driven almost exclusively by multiple and not earnings, as has been the case this year,” Wilson said.

The S&P 500 has advanced 19% this year, almost the same return it posted in 2019 over the same period as it rebounded from a decline the previous year. In 2023, investors have looked past an earnings recession as the US economy holds up better than expected, bolstering hopes for a soft landing.

“The 2019 analogy, in and of itself, suggests more index level upside from here, though we’d note that the Fed was already cutting rates for a good portion of 2019, and the market multiple is already close to 1 turn higher than where it peaked during that period,” Wilson said.

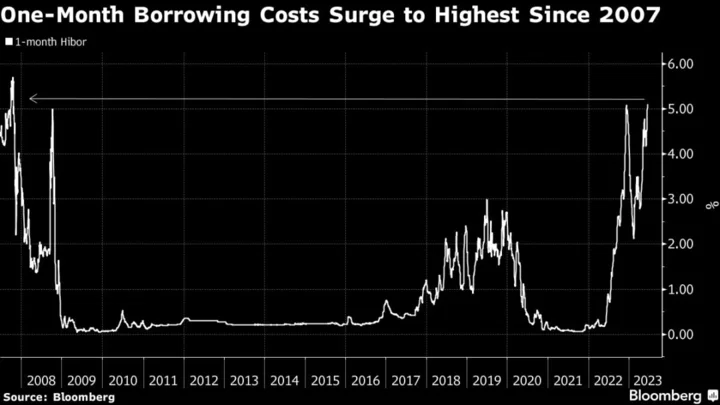

Fed policymakers lifted borrowing costs again at their policy meeting last week for the 11th time since March 2022. While Chair Jerome Powell pointed to encouraging signs that the Fed’s rate hikes are working to curb price pressures, he reiterated that policymakers have a long way to go to return inflation to their 2% goal.

While Wilson — who correctly predicted the selloff in stocks in 2022, though his bearish outlook is yet to materialize this year — said his team is open to the view that the economy could eventually enter a new upturn cycle. Still, “we’d like to see a broader swath of business cycle indicators inflect higher, breadth improve and front-end rates come down before adjusting our stance in this regard,” he said.

--With assistance from Sagarika Jaisinghani.