The long-term prospects for artificial intelligence-linked semiconductors is making Morgan Stanley even more bullish about chip stocks in Greater China, Japan and South Korea.

The US broker upgraded the sector in China to attractive from in-line and lifted price targets for Korea’s Samsung Electronics Co. and SK Hynix Inc. Japan’s chip sector was also raised to attractive from in-line, with Disco Corp. climbing to overweight.

“We expect tech deflation — price elasticity — coupled with secular AI semi demand will together trigger the next logic semi upcycle,” Morgan Stanley analysts including Charlie Chan wrote in a July 6 note. “Historically, the reversion of semi inventory days is a strong signal” for stock price appreciation, they added.

Global sales data reported by the Semiconductor Industry Association for May showed signs of bottoming out, with revenue rising 1.7% from April, according to a note from Nomura Holdings Inc.

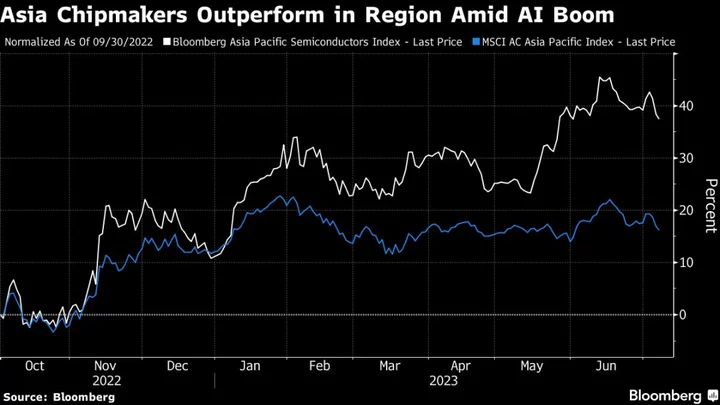

Morgan Stanley is expanding its bullish view on the region’s chipmakers after having upgraded some names in South Korea and Taiwan back in October. Since then, chip gauges in both nations have surged more than 27%.

The firm said it had seen a rush of orders over the past two weeks for AI semiconductors, revising up earnings for players such as Taiwan Semiconductor Manufacturing Co. and recommending that investors participate in a smartphone recovery. Will Semiconductor Co. was upgraded to overweight.

In a separate note, analysts including Shawn Kim said Korea’s memory chipmakers were set to benefit from a growth of nearly 10 times in the DRAM market to $19 billion over the next four years. SK Hynix was their top pick.

The firm’s bullish view came before Samsung announced its worst quarterly revenue since at least 2009.

“We are likely to see EPS power expectations meaningfully raised over the coming years behind the emergence of high bandwidth memory and accelerating demand for AI servers,” Kim wrote.

(Updates with Samsung’s earnings results in penultimate paragraph.)