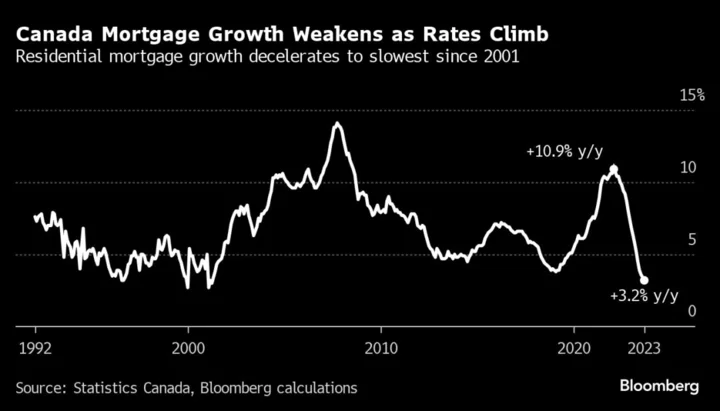

Mortgage growth in Canada is the slowest it’s been in more than two decades as higher borrowing costs and elevated prices for homes and apartments weigh on real estate activity.

Residential mortgage credit rose just 3.2% from a year earlier, reaching C$2.14 trillion ($1.6 trillion) in September, the weakest annual rate of growth since 2001, according to data released Friday by Statistics Canada.

That’s down from as high as 10.9% at the beginning of 2022, marking one of the fastest decelerations in credit growth in data going back to the early 1990s.

The report confirms that the Bank of Canada’s aggressive rate hikes are working to cool household borrowing, restricting their ability to spend and to finance property purchases, as policymakers seek to temper inflation. In the spring of 2001, the central bank’s benchmark overnight rate was around the 5% mark, as it is now.

The data match the slowdown being seen at real estate offices throughout the country. Elevated borrowing costs are a major reason why homes haven’t been this unaffordable since the early 1990s, when Canada had double-digit interest rates.

The balances of home equity lines of credit, a product that allows consumers to borrow against the difference between their mortgage balance and the value of their home, fell to C$165.8 billion in September, down 3.4% from a year earlier.

Canadians have the highest household debt among the Group of Seven countries, a big reason most economists view its economy as more sensitive to higher interest rates than the US. Most economists expect the Bank of Canada to begin cutting rates in the second quarter of next year, and traders in the swaps market are betting that policymakers will lower the policy rate by June.