NatWest Group Plc is reeling from the resignations of two high-level, veteran executives following missteps that placed them — and the bank’s commitments to climate change and building a diverse workforce — smack at the center of the spreading corporate culture wars.

Chief Executive Officer Alison Rose quit early Wednesday after admitting she spoke with a journalist about the decision to close Brexit-campaigner Nigel Farage’s account at Coutts & Co., NatWest’s private banking unit. On Thursday, Coutts head Peter Flavel also stepped down.

“This incident is a clear failure of governance,” said Alexander Stafford, a Conservative member of parliament and chair of the All-Party Parliamentary Group on Environmental, Social and Governance, which seeks to help the government meet policy objectives such as net zero, combating modern slavery and improving corporate governance.

“In financial services, as in ESG itself, trust is paramount — especially in light of the anti-ESG sentiments we see across the Atlantic — and clearly failure in any of E, S, or G leads to failure in them all,” Stafford added.

While any breach of client confidentiality resonates particularly loudly in banking circles, the swift condemnations of NatWest also were fueled by growing political opposition to the bank’s environmental and social advocacy.

In the US, the recoil has been gaining momentum since last year when Florida Governor Ron DeSantis and former US Vice President Mike Pence, plus business leaders including Elon Musk, railed against strategies like ESG investing.

Rose’s ouster indicates “likely intimidation by this enormous push against the so-called woke ESG agenda,” said Sasja Beslik, chief investment strategy officer at SDG Impact Japan. “The playbook from the US against ESG is now taking a grip on the UK.”

Beslik and others worry that the opposition to ESG will ultimately be successful in undermining the finance industry’s commitments to funding the energy transition or building a diverse workforce.

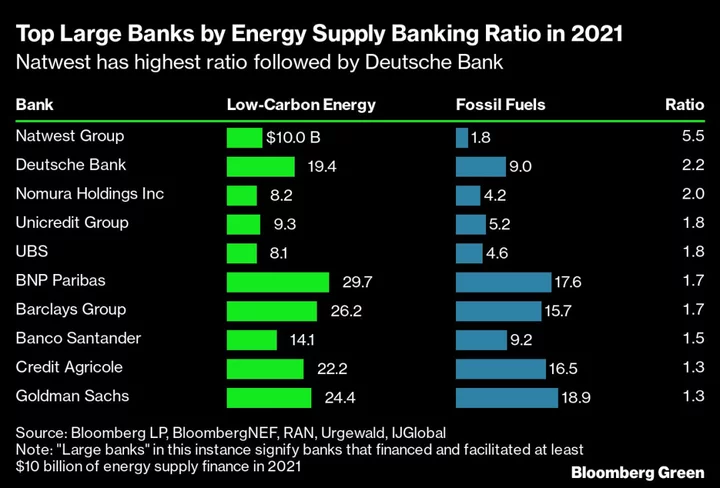

As recently as 2021, NatWest provided more than five times as much finance to low-carbon energy projects as to fossil-fuel businesses, the best ratio of all major lenders studied by analysts at BloombergNEF.

Others are concerned about the impact on social issues, including gender representation. After Rose’s resignation, all of the UK’s big banks are helmed by men.

“It would be a shame if there’s now a pushback on diversity and inclusion,” said Keith Mullin, founder of KM Capital Markets, a consulting firm. “I’m hoping [the Coutts-Farage row] would be seen as an overzealous application of social value.”

James Vaccaro, executive director at Consumer Safe Lending Network, said banks need to focus on the wider impacts that they have on the community, society and the environment.

“These were issues where Rose was leading NatWest in the right direction,” he said.

Anti-ESG rhetoric has gathered more momentum in the US compared with the UK, at least for now. That may change with the UK elections coming up, said Michael Evans, director at Byfield, a litigation and reputation consultancy. “There are certainly incentives for the Conservatives, in particular, to probably go a little bit further.”

--With assistance from Alastair Marsh.