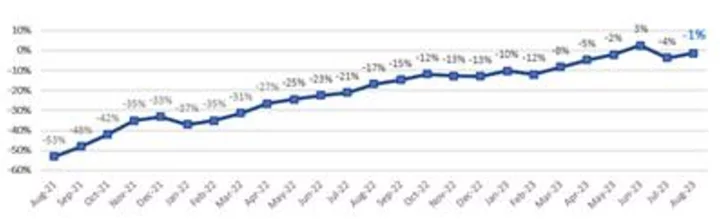

Oil edged lower after capping seven weeks of gains — the longest rally since mid-2022 — driven by signs of a tightening market.

West Texas Intermediate fell below $83 a barrel following the 20% surge in that span. Global crude demand has swelled to a record 103 million barrels a day amid robust consumption in China and elsewhere, threatening to push prices higher, the International Energy Agency said in a report on Friday.

Signals from the physical market reinforce that picture. Indian purchases of Russian crude are showing no sign of letting up even as prices rise, while flows from the world’s biggest seller to the largest buyer — Saudi Arabia to China — are set to soar as a new mega-refinery begins operations.

Crude has risen by about a quarter since its lows in June as OPEC+ linchpins Russia and Saudi Arabia curtailed supply. That’s helped push the market into a deficit of more than 2 million barrels a day this quarter, the producer group has estimated. Rising risks to flows of Russian crude through the Black Sea amid the war in Ukraine have also aided gains.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.