Banca Monte dei Paschi di Siena SpA was the lead decliner on the Italian stock benchmark index amid concern by analysts and investors about the lack of a clear strategy for the state’s sale of its stake.

The stock fell as much as 3% Monday and traded down 1.7% as of 12:20 p.m. in Milan. Monte Paschi shares have risen 29% so far this year, giving the bank a market value of €3.1 billion ($3.3 billion).

Any merger or acquisition process would be complex in the short term, Luigi De Bellis, an analyst at Equita Group SpA said in a note Monday, while “placing a significant stake on the market without the identification of a strategic partner may pose an overhang risk for the stock.”

Deputy Prime Minister Antonio Tajani, who took over the business-friendly Forza Italia party after the death of its founder Silvio Berlusconi, told Bloomberg Television at the weekend that the government should accelerate its efforts to sell a controlling stake in Monte Paschi.

But members of fellow-Deputy Premier Matteo Salvini’s anti-immigrant League party — the other junior partner in the right-wing alliance — retorted that the sale of Paschi shouldn’t be rushed.

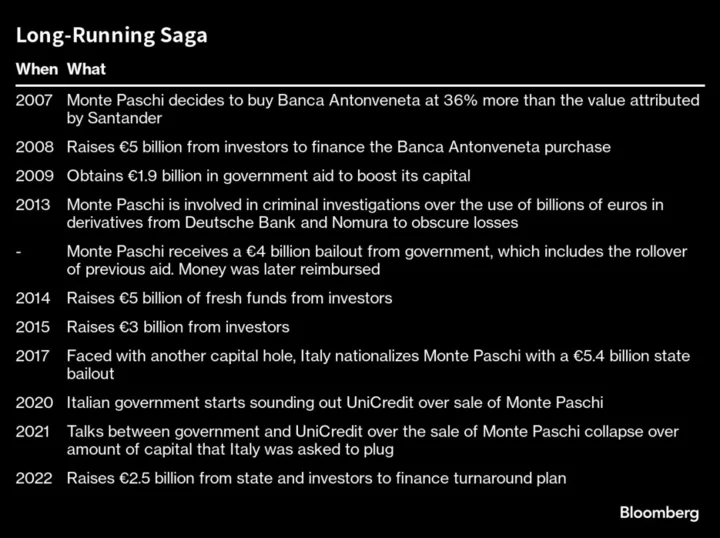

Siena-based Monte Paschi, which went through years of painful turnaround efforts after an initial bailout in 2009, has made significant progress in its most recent plan to revive profitability under Chief Executive Officer Luigi Lovaglio, making the bank more appealing to investors.

The government injected €1.6 billion in fresh money in November, amid a €2.5 billion capital increase. This was Italy’s latest effort to help reshape the bank’s finances after the bank burned about €18 billion in investor and taxpayers’ cash since 2008.

A sale of the government’s entire stake of about 64% at the current share price would raise more than €2 billion, with a gain compared to the last recapitalization, but still far from recovering all injected funds.

Fabio Caldato, a partner at Olympia Wealth Management, said that without a merger or an acquisition, “one or more placements of Monte Paschi shares are likely.” So far no deal has been concretely implemented, and “the very low visibility on the bank makes us uncomfortable to own the shares,” he added.

--With assistance from Tommaso Ebhardt and Steven Arons.