Federal Reserve officials paused their series of interest-rate hikes but projected borrowing costs will go higher than previously expected, owing to what Chair Jerome Powell called surprisingly persistent inflation and labor-market strength.

Powell, speaking to reporters in a press conference Wednesday, faced the challenging task of explaining two possibly contradictory policies: deciding to leave rates unchanged following 10 straight hikes while also indicating that at least two more increases might be necessary this year, possibly as soon as July.

“The committee thought overall that it was appropriate to moderate the pace, if only slightly,” Powell said. “That gives us more information to make decisions. We may try to make better decisions. It allows the economy a little more time to adapt as we make our decisions going forward.”

Yet the surprisingly high projections may also reflect a return to the Fed’s strategy of cooling a resilient economy while slowing its tightening campaign from the aggressive pace of last year — a strategy that was derailed by a string of bank collapses in March.

Pausing rate hikes while at the same time signaling further potential increases “gives them maximum flexibility,” said James Knightley, chief international economist at ING. “They have laid the groundwork for a hike if the data remains hot, but can easily reverse course if it’s softer.”

Higher Forecasts

Policymakers on Wednesday left rates in a range of 5% to 5.25%, taking their first breather in a 15-month hiking campaign that included four jumbo-sized 75-basis-point increases last year.

Officials began moderating the pace of policy tightening in December, and delivered quarter-point hikes at each of the first three meetings this year.

Asian stocks climbed Thursday after the Fed’s pause and China’s cut to a key lending rate to support its struggling economy. The dollar rose.

But with economic data coming in stronger than expected, and progress on inflation slower by some measures, officials this week lifted expectations for how much more they need to do to contain price pressures.

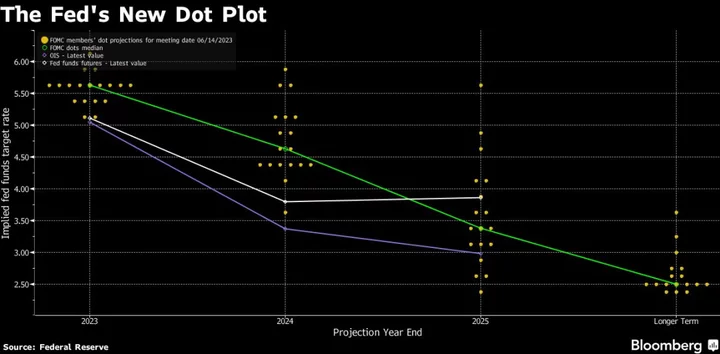

The median estimate of Fed participants’ projections is now for rates to rise to 5.6% by the end of this year, implying two more quarter-point increases, up from 5.1% in March.

Bond traders almost wiped out bets that the Fed will cut rates this year, but they don’t expect borrowing costs to rise as high as central bankers project.

“The level of 5.6 is pretty consistent, if you think about it, where the federal funds rate was trading before the bank incidents of early March, so we’ve kind of gone back to that,” Powell said.

Options Open

Powell suggested policymakers want to keep their options open over the coming months as they assess how previous moves are affecting the economy.

Now that rates are at or very close to most participants’ estimate of restrictive levels, a meeting-by-meeting approach to tightening — if more is needed at all — will enable them to respond to data as it comes in.

It will also help them avoid committing to something ahead of time that then doesn’t seem appropriate in the moment, a tough lesson learned as inflation was on the rise.

It’s a tough message to communicate. The Fed’s post-meeting statement gave a clearer signal of additional increases, and the dot plot of rate estimates showed more hikes than central bank watchers had forecast before the gathering.

What Bloomberg Economics Says...

“We interpret this dot plot as a jawboning tool – a way for the Fed to pre-empt further easing in financial conditions in response to its rate pause, even if the additional tightening is unlikely to be fully delivered. ... [W]e believe that inflation will likely be lower than these projections by year-end, and ultimately the Fed will hike less than what the new dot plot indicates.”

— Anna Wong, Stuart Paul and Eliza Winger, economists

To read the full note, click here

Powell was careful to avoid committing to much of anything in the future. While acknowledging the two additional rate hikes many of his colleagues penciled in, he repeatedly emphasized that they are only forecasts and that the evolution of the economy is uncertain.

At the same time, he was unwavering in his commitment to bringing inflation down to the Fed’s 2% target.

“Powell tried to square the pause with the much-higher dots, with some success,” said Derek Tang, economist with LH Meyer/Monetary Policy Analytics.

Hardest Mile

Wednesday’s changes to the statement, dot plot and Powell’s messaging offer a glimpse of the orchestrating that was likely done ahead of the meeting among the central bank’s 18 participants.

“The meeting was clearly an uncomfortable consensus where everyone got something, but nobody got away happy,” Tang said. “It will be an uphill battle to hold it all together until the fall, let alone year-end.”

Between the May and June meetings, a sizable minority of officials said that inflation and labor market data so far hadn’t convinced them that a pause was warranted.

Policymakers will see another round of inflation and jobs data before their July 25-26 gathering. In another bid to keep all options on the table, Powell said Wednesday that the meeting next month will be a “live” one, indicating that a rate increase or continued pause are both in play.

“We have come far but have yet to hit the hardest mile of what has proven to be a long marathon in the battle to contain inflation,” said Diane Swonk, chief economist at KPMG LLP in Chicago. “The upward revisions to core inflation forecasts by the Fed speak volumes about the fear of too high of a floor forming on inflation.”

--With assistance from Jonnelle Marte.

(Updates with Asia markets in eighth paragraph.)