Shares of Indian billionaire Gautam Adani’s group will be in focus Monday after boards of two companies, including the flagship, approved proposals to raise as much as $2.6 billion.

Adani Enterprises Ltd., the incubator for new group businesses, got a nod to raise as much as 125 billion rupees ($1.5 billion) through a Qualified Institutional Placement or other modes, according to an exchange filing Saturday. Adani Transmission Ltd. can seek up to 85 billion rupees via similar methods, the utility said separately.

Pricing will be key, with equity dilution another factor to watch, analysts said.

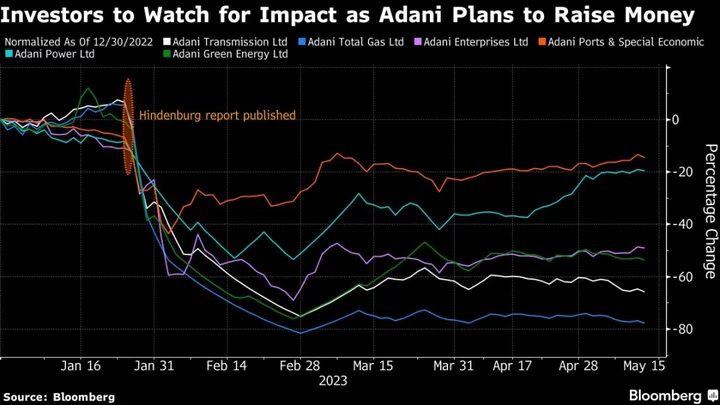

The plans come as the ports-to-power conglomerate continues a comeback strategy after being hit by allegations of accounting fraud and stock manipulation from US short-seller Hindenburg Research in late January. While the group has denied the accusations, it has been in damage repair mode ever since and has tried to win back investors with roadshows and early debt repayments.

“Things have been kind of settling down for the Adani Group, especially after GQG’s investment gave its shares a strong backing,” said Kranthi Bathni, director at WealthMills Securities Pvt. in Mumbai. “Raising fresh funds also provides comfort to lenders.”

Adani Green Energy Ltd. was also scheduled to hold its board meeting but deferred it to May 24, citing “certain exigencies.”

The combined market capitalization of the 10 Adani group stocks is down about $118 billion from the level before the bombshell Hindenburg report was issued on Jan. 24. The selloff had at one point erased more than $150 billion from the group’s value.

The rebound in stocks began when US-based GQG Partners in early March bought stakes from the Adani family in four group companies for $1.9 billion. GQG’s Rajiv Jain told Bloomberg then that Adani firms have “phenomenal, irreplaceable assets.” In April, the investor said these stocks could be “multibaggers” over five years.

“While the promoters had deleveraged their own personal loan book by selling their shares to GQG, the companies still needed to deleverage,” said Abhay Agarwal, founder of Mumbai-based Piper Serica Advisors Pvt, referring to the Adani family.

“The only concern for investors would be that this kind of activity assurance will put a cap on the market price for some time because with the free float increasing by issuance of new shares, the demand in secondary market would reduce,” he added.

Regulatory Watch

Meanwhile, sentiment may also get a lift from a move by India’s two largest bourses to remove shares of Adani Transmission, Adani Green and Adani Total Gas Ltd. from a list of firms on the so-called additional surveillance measure. Companies on the watchlist face trading restrictions, including margin limits, price band caps, and other curbs meant to protect investors.

The nation’s markets regulator is looking into any possible violations as well as unusual market activity in Adani group stocks in the wake of the shortseller attack. The Supreme Court of India is awaiting a report from the regulator, which has requested for more time as it collates financial data on the conglomerate locally and overseas. The apex court will be hearing the matter on Monday.

Shares of Adani Enterprises rose last week as the company flagged the board meeting on fundraising. Adani Transmission however slumped as global index provider MSCI Inc. said it will exclude its stock, and that of Adani Total, from its India gauge at the end of this month.