A company that caters to the Hollywood private-jet set is tapping the municipal market to help it expand in Connecticut, where it hopes to serve the uber rich.

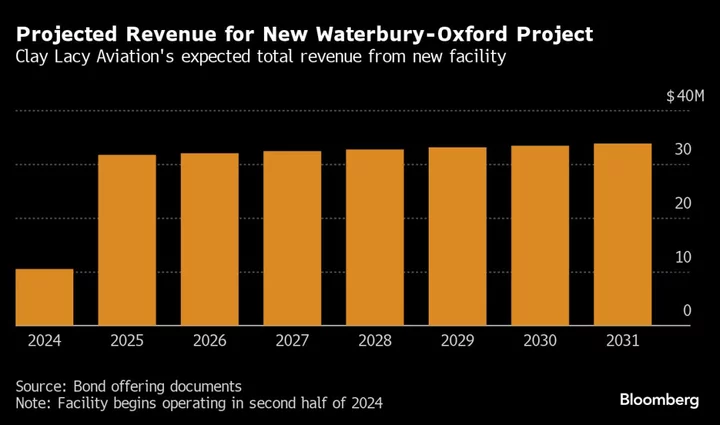

The unrated $43.8 million deal is being sold through the Wisconsin Public Finance Authority, a conduit issuer, for Clay Lacy Aviation Inc. to fund new construction and improvements at the Waterbury-Oxford Airport in Oxford, Connecticut, which is located about 80 miles from Manhattan.

The Clay Lacy Aviation bond sale is one sign that the junk segment of the municipal bond market is back, according to Jason Appleson, head of municipal bonds at PGIM Fixed Income. A number of junk and unrated bond issues struggled to find buyers this summer.

“I am seeing evidence of a growing high-yield pipeline,” Appleson said in an email. “The pipeline includes dirt deals, senior living, and project finance deals such as a vegan leather mushroom farm and this fixed-base operator.” Those operators, called FBOs, typically provide fueling and hangar rental services to general aviation and noncommercial aircraft.

“However, I do think investors are going to be more discerning this go around,” he said. “Many investors have been burned on high-yield deals in these sectors with challenges brought on by Covid, ill-conceived business plans and/or poorly structured deals.”

FBOs don’t usually tap the municipal market, but that may change, according to Seth Lehman, senior director of Fitch Ratings and lead analyst on the October report “Major US Airports Brace for Renewed Traffic Growth with Big Spending Plans.”

“Airport capital investments are picking up with passenger traffic now moving past pre-pandemic highs, which is also pointing to more of an appetite to borrow in the lending markets and particularly the riskier niches of private aviation,” Lehman said in an email.

Read more: Muni Sale Is a Bet on Private Luxury Jets in Hawaii: Joe Mysak

The new bonds will be sold in minimum denominations of $500,000, rare in the municipal market, and indicative of their risky nature; the more typical minimum denomination for high-yield debt is $100,000.

Clay Lacy Aviation declined to comment. Wells Fargo Securities, the lead underwriter of the bond sale, declined to comment. The bonds are set to be priced on Thursday.

Catering to the Affluent

Founded in 1968, Clay Lacy Aviation flies out of Van Nuys and John Wayne airports in southern California and primarily serves the entertainment industry, according to a market analysis included in bond offering documents. Clay Lacy also operates aircraft maintenance, management and jet charter services.

In 2016, the company entered the East Coast market by purchasing Key Air, a private aviation company at Waterbury-Oxford, according to the documents. Proceeds from the bond sale will be used to build a new full-service FBO at the Waterbury-Oxford Airport, including a terminal building and three new hangars. The company also intends to make an equity contribution of more than $11 million to the project.

Clay Lacy is targeting a tiny crowd. Its new Oxford facilities, located about 50 miles from hedge-fund capital Greenwich, “will serve one of the most affluent regions of the United States in terms of 2021 per capita personal income,” with Connecticut ranking the second wealthiest state, according to the bond documents.

“Private aviation is expensive – owning and maintaining a private jet or chartering one can easily cost millions, tens of millions of dollars, or more,” according to the documents. “Among the top 1%, only 237,331, or about 0.14% of the total, earned more than $1 million [in 2021]. Clay Lacy Oxford will cater specifically to these high wage earners.”

Hangar space in the New York area is in high demand, with long waitlists, according to the documents.

New York City-area airports don’t provide enough private aviation services to meet demand, so corporate travelers flying to the region may opt to store their planes at Waterbury-Oxford Airport, the documents said, noting that the new site “will serve primarily as an overflow and remote parking facility.”

--With assistance from Sam Hall.