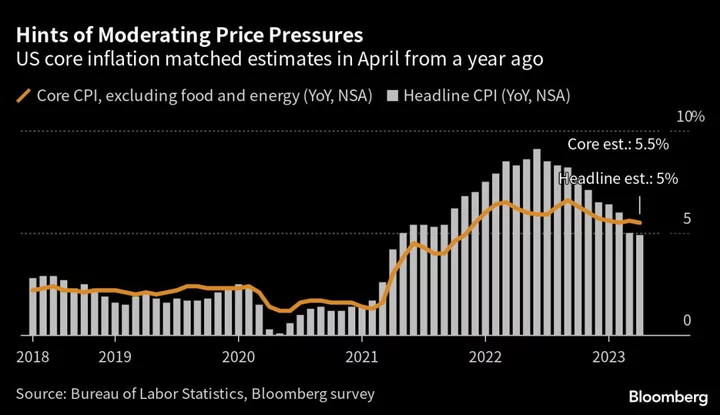

Australia’s central bank revised down its estimates for economic growth a touch and now sees inflation returning to within its 2-3% target band at the end of 2025, suggesting interest rates may remain elevated for longer.

The Reserve Bank sees headline inflation at 2.8% by December 2025 – the first time in this forecast horizon that CPI comes inside its target band, according to the quarterly Statement on Monetary Policy released Friday. In May, the RBA predicted inflation will hit 3% by mid-2025 but that has now been edged up to 3.1%. Gross domestic product growth is seen hitting a trough of 0.9% this year, down from 1.2% previously, and then accelerating to a still-subdued 1.6% a year later.

The estimates are based on the cash rate peaking at 4.25% by the end of this year, then declining to 3.25% by end-2025 and underscores the RBA’s more cautious approach to its tightening cycle compared with global counterparts. Its 4 percentage points of hikes is well below the Federal Reserve’s 5.25 points. Many economists including ANZ Bank and Commonwealth Bank of Australia are now predicting an “extended pause” for the RBA at the current 4.1%.

“The board’s current assessment is that the risks around the inflation outlook are broadly balanced,” the RBA said. “But it recognizes that the crystallization of upside risks would increase the likelihood of inflation staying high for longer and a rise in medium-term inflation expectations. If inflation expectations were to rise, the result would be even higher interest rates, a more substantial slowing in the economy and a larger rise in unemployment to bring inflation back to target.”

The RBA warned that inflation at around 6% is “too high” with services prices likely to persist for while driven by ongoing labor market tightness and rising energy costs. Rent inflation is also set to remain high as surging population growth in recent quarters adds to demand in an already tight market.

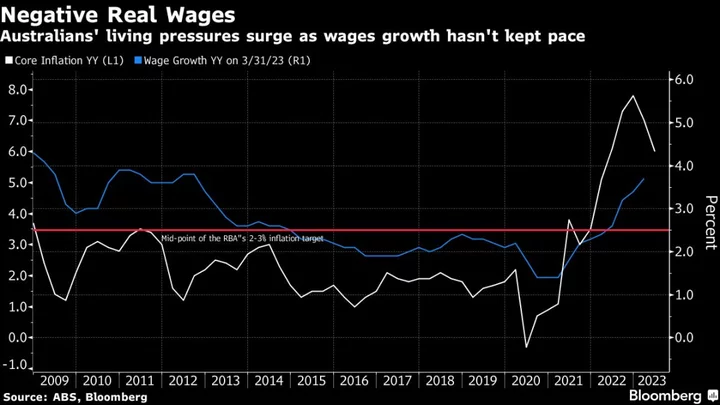

Another factor adding to inflation is strong wages growth which is now seen peaking at 4.1% this year, from 4% in May. The RBA highlighted the likelihood of persistent increases in staff pay and poor productivity growth among upside risks to inflation. On the other hand, declines in global cost pressures and tepid inflation in China could bring down overall consumer prices.

The forecasts embed a higher rate profile over the forecast period than three months earlier, “because of increases in the cash rate in May and June. But there are other forces working in the opposite direction, including from higher-than-expected population growth and an earlier-than-expected recovery in the established housing market,” the RBA said.

The housing market has staged a surprising turnaround, rising for five consecutive months through July amid the combined effects of high demand buoyed partly by strong population growth and limited supply. In addition, construction activity continues to be limited by capacity constraints because of labor shortages and a tightening of financial conditions.

The RBA highlighted household consumption as a “key source” of uncertainty, though a resilient labor market and higher house prices are likely to support sentiment.

The central bank sees household consumption growth slowing to 1.3% by end-2023 from 5.4% last year. That is a major headwind for the broader economy given private consumption accounts for two-thirds of Australia’s GDP.

Unemployment is seen rising to 3.9% this year, from 3.5% at present, and then gradually climbing to 4.5% by mid-2025 – still below its pre-pandemic level.

The RBA also highlighted some insights from its business liaison program:

- Sentiment among retailers has continued to deteriorate over recent months, though spending on discretionary services such as major events remains elevated

- Private sector wages growth is still tracking around 4%

- Firms are increasingly cautious about passing on price increases

- Hiring intentions are little changed

- Exports are expected to grow over the period ahead driven by demand from students from South Asia and with commodity shipments generally expected to rise