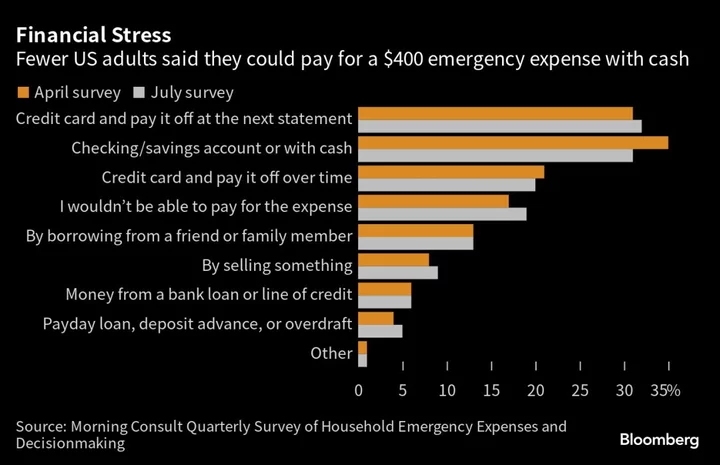

Fewer Americans can afford to foot a $400 emergency expense compared with last quarter, according to a new survey.

The share of US adults who said they could cover a surprise $400 bill in the third quarter without taking on debt dropped two percentage points to 46%, according to a poll conducted by decision intelligence company Morning Consult for Bloomberg News.

Just over one third of respondents said they’d need to use some sort of debt, such as borrowing from credit cards. Almost one in five people said they would not be able to pay at all.

The figures highlight that US adults are increasingly vulnerable in an era of high prices, despite recent signs of disinflation and strong consumer demand.

The data highlight widespread financial fragility, with 21% of Black and Hispanic adults and 19% of White adults unable to pay for the emergency expense. More than one in five students said they’d be unable to pay right way, an increase of 3 percentage points from last quarter.

“We’ve had a lot of positive economic news lately, but there are a lot of consumers who aren’t really feeling this resilience,” Morning Consult Senior Economist Kayla Bruun said in an interview. In particular, people earning less than $50,000 a year are still suffering from higher prices, she said.

High earners were more than twice as likely than lower-income adults to say they’d pay the $400 with cash or equivalents, an increase of 3 percentage points to 71%. The share of middle- and low-income earners who said they’d be able to cover the expense each declined two points to 57% and 33%, respectively.

The widening income gap when it comes to emergency expenses could be attributed to strain from the March expiry of SNAP benefits and anticipated financial pressures from student-loan repayments due this fall.

Meanwhile, most categories of respondents said their actual emergency expenses increased. This was especially true for medical emergencies, which rose to a median of $380, up $62 from last quarter.

The Morning Consult survey was conducted between July 10-15 among more than 11,000 respondents.