Signa is holding last-ditch talks with investors, hoping to secure a funding lifeline and avoid a wave of insolvencies in the €23 billion ($25 billion) property empire.

One unit of the sprawling conglomerate founded by Austrian tycoon Rene Benko already filed for insolvency on Friday, and further notifications may follow in coming weeks, according to two people with direct knowledge of Signa’s efforts.

Recent negotiations to meet up to €600 million in immediate funding needs have hit a roadblock, and — while some discussions are ongoing and other options are being considered - the probability of an agreement is low, according to the people, asking not to be named discussing internal matters. Signa’s complex capital structure is making plans difficult to implement, they said.

A spokesman for Signa didn’t respond to an email and call seeking comment.

The late efforts, and internal doubts, underscore the precarious situation for Signa, which risks becoming one of the most prominent victims of turmoil in European real estate markets due to rising interest rates and diving real estate valuations.

As recently as last year, Signa was still lapping up luxury property in a culmination of two decades of exponential growth that started with Benko converting attics in his home town of Innsbruck. Together with the Thai Central Group, it closed the multi-billion pound purchase of London’s Selfridges department store chain, adding to a portfolio that already included the Chrysler Building in New York, and Berlin’s KaDeWe.

Benko used to ground his strategy on the idea that only the Catholic Church and the Queen of England can boast a comparable portfolio of unique locations.

But the market headwinds have been difficult to overcome, and Signa sought external advisers earlier this month to help secure funding and help untangle an opaque network of obligations spread across dozens of subsidiaries. Restructuring expert Arndt Geiwitz replaced Benko as chairman of the company’s advisory board.

Ralf Schmitz, who was named a board member and Chief Restructuring Officer by Signa in a Nov. 10 statement, ultimately declined the appointment and has been advising the company in an informal role, according to one of the people.

A broader insolvency would leave a wide range of investors struggling to recoup their money. Signa’s shareholders — the first in line to take losses — include some of Europe’s richest families, including Austrian construction tycoon Hans Peter Haselsteiner and German transportation magnate Klaus-Michael Kuehne.

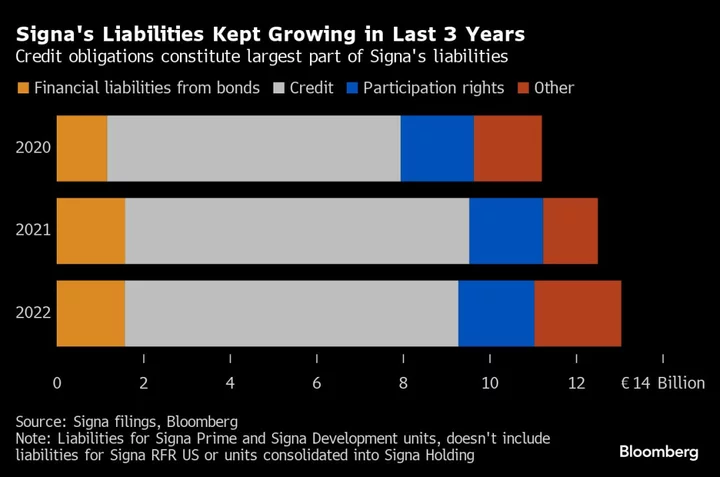

Signa Prime and Signa Development, the two largest property units, held €1.76 billion in liabilities related to profit participation rights at the end of 2022. Holders of a €300 million bond issued by Signa Development - the conglomerate’s only publicly traded security - include London hedge fund Arini. Saudi Arabia’s Public Investment Fund has a junior debt position distributed throughout the Signa companies.

The largest swathe of debt is owed to banks that mostly provided loans for individual construction projects and purchases. While their credit may be among the safest, Signa’s difficulties risk eating into bank profits and bruising balance sheets.

Shares of Swiss wealth manager Julius Baer Group Ltd. plunged 16% this week after it warned rising risk costs would lower this year’s profit. The investment company has about €600 million in outstanding loans to Signa and the exposure was the main reason behind recent credit provisions, Bloomberg reported earlier this week.

Other banks that have lent money to Signa include the Austrian Raiffeisen cooperative sector, UniCredit SpA and several German regional lenders.

The European Central Bank asked several Signa creditors to take a financial hit on related exposures after months of scrutiny of banks that worked with the company in Austria, Germany and other European countries, Bloomberg News reported in August.