Airline, hotel and cruise stocks have jumped since late May as consumers rush to travel, but the outlook for later this year is murky and higher interest rates may take their toll on the shares.

The S&P Supercomposite Airlines Index and the S&P Composite 1500 Hotels, Resorts & Cruise Lines Index are both near highs last touched in mid-2022, rising steadily in recent weeks. SkyWest Inc., Hawaiian Holdings Inc., Delta Air Lines Inc., Carnival Corp., Norwegian Cruise Line Holdings Ltd. and Royal Caribbean Cruises Ltd. have led the advances in both groups, with Carnival set to end this week at the top of the S&P 500.

The summer months in the US and Europe often spur a flurry of flying and driving, and there are signs that this season will be good for travel companies. The airline industry’s main trade group this month doubled its forecast for global net profit in 2023 to $9.8 billion, thanks in part to a surge in flying in North America and Europe. Cruise line operators are seeing a jump in demand.

But once summer vacation season fizzles out, it’s harder to forecast how much consumers will be willing to spend. Pent-up demand for vacationing after the pandemic seems to have mostly petered out, and it’s not clear how much business travel will pick up from here, said Bloomberg Intelligence’s senior analyst George Ferguson.

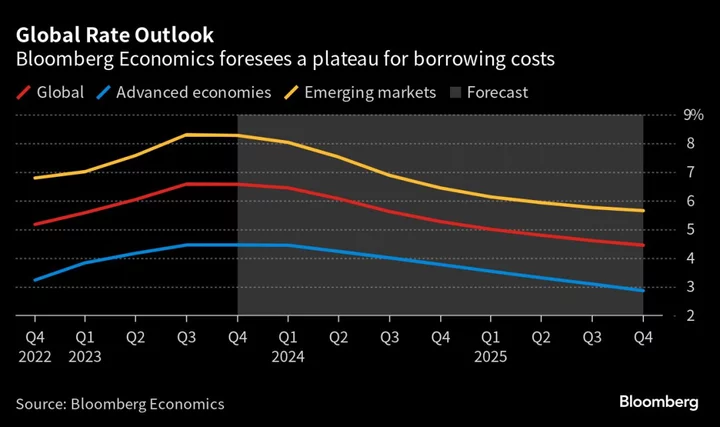

“Airline stocks have run pretty hard and they are among top performers in the S&P,” Ferguson said. However, he questions the the bullish assumption behind the rally that “the consumer is ready to meaningfully spend more on air travel and consume the same amount as previously” amid still-high interest rates and the possibility of a recession.

The two gauges of airlines and of hotel and cruise stocks are set to record their third straight weeks of gains, with Delta just coming off a 15-day win streak, its longest ever. A budding optimism about the US economy and a wider market rally have contributed to the strength in the group. At the same time, the price of oil has dipped sharply lower in the past three months, easing some of the cost pressures on airlines and cruise companies.

The US Global Jets ETF — which tracks the airline industry’s shares — is also on a stellar run, rising for 9 straight days, the biggest winning streak for the fund since Jan. 17.

Short Bets

Yet, a peek into the fund’s inflows suggests investors still have concerns about the stocks. Investors have taken assets out of the ETF for the past four quarters, with the three-month period ending in June also set to see outflows.

If anything, the rapid gains in airlines are fueling some short bets against the group, shrugging off the projections for record-high travel this summer. According to data from S&P Global Market Intelligence, short interest in passenger airlines was at 5.37% at the end of May, up 67 basis points from the end of January and the highest level of short interest in the industry in nearly a year.

Meanwhile, the pressure that airlines face could hit other travel-related companies, including hotels and cruise companies, as well as financial firms such as American Express Co. Earlier this week, Citi analyst Arren Cyganovich warned that the company was exposed to slowing spending trends. The credit-card company’s customers typically have high spending in travel and entertainment, making it a good barometer for the travel trends broadly.

All together, while travel stocks, especially airlines, are enjoying a nice run amid a broader market euphoria, a longer-lasting recovery in this group is expected to remain difficult.

“I don’t think airlines face clear skies at all,” BI’s Ferguson said. “The big question remains — is the consumer ready to spend more and consume the same or more? Or is this a bounce-back that will fade?”

--With assistance from Janet Freund.