By Kate Holton and Nick Carey

LONDON (Reuters) -British car plants will close with the loss of thousands of jobs unless the Brexit deal is swiftly renegotiated, Stellantis has said, the latest in a series of warnings from the auto industry since the country left the European Union.

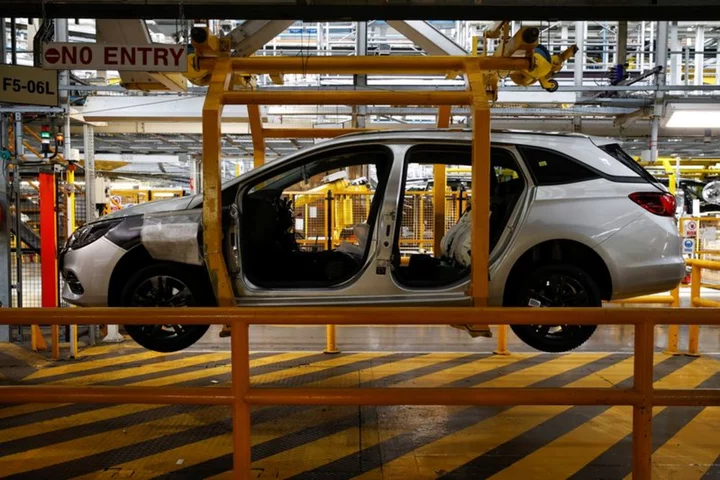

The world's No. 3 carmaker by sales and owner of 14 brands including Vauxhall, Peugeot, Citroen and Fiat told lawmakers that under the current deal it would face tariffs when exporting electric vans to Europe from next year, when tougher post-Brexit rules come into force.

Stellantis wants the government and the European Union to extend current rules on the sourcing of parts until 2027 instead of a planned change in 2024 - a request that was echoed by the lobbying body for the European car trade.

Britain said it was in talks with Brussels.

"We hope to be able to come to a resolution with the EU on this," Prime Minister Rishi Sunak's spokesman told reporters on Wednesday.

Auto manufacturers say that as well as renegotiating tariffs, Britain needs to attract more battery production to secure the future of its car industry.

British finance minister Jeremy Hunt hinted there would soon be a development on that front.

"Watch this space, because we are very focused on making sure that the UK gets EV and manufacturing capacity," he told an event on Wednesday.

EXISTENTIAL CRISIS

The potentially existential problem facing Britain's car industry is closely tied to the shift to EVs.

Under the trade deal agreed when Britain left the bloc, 45% of the value of an EV being sold in the European Union must come from Britain or the EU from 2024 to avoid tariffs.

The problem is that a battery pack can account for up to half a new EV's cost. Batteries are also heavy and expensive to move long distances.

Experts have been warning since Britain left the EU at the end of 2020 that without a number of EV battery gigafactories the country could lose a hefty chunk of its car industry.

Only Japan's Nissan has a small EV battery plant in Sunderland, with a second one on the way.

Britishvolt, a startup which received UK government support for an ambitious 3.8 billion pound ($4.80 billion) battery plant at a site in northern England, filed for administration in January after struggling to raise funds.

The company was then bought by Australia's Recharge Industries, which has yet to unveil plans for the site.

Andy Palmer, former Nissan chief operating officer, told BBC radio that urgent action was required.

"The cost of failure is very clear. It's 800,000 jobs in the UK, which is basically those jobs associated with the car industry," said Palmer, who is also chairman of European battery manufacturer InoBat.

"If you don't have a battery capability in the UK, then those car manufacturers will move to mainland Europe."

Europe's car trade body, ACEA, agreed with Stellantis and called on the European Commission to extend the phase-in period, saying the supply chain was simply not ready yet.

Britain's Society of Motor Manufacturers and Traders said in a submission to parliament that current manufacturing capability in the EU and Britain would not allow the sector to meet the requirements for batteries and battery parts.

The warnings come as carmakers globally are selecting sites to build new battery gigafactories.

Last week the chief financial officer of Tata Motors, owner of Jaguar Land Rover, said it had not decided on a location for a new battery plant but advanced talks were underway.

Reuters reported in February that Tata was considering building an EV battery plant in Spain or Britain.

Stellantis announced a 100 million pound ($126 million) EV investment in its Ellesmere Port site in 2021. It said in the submission it had believed then that it could create enough parts in Britain or Europe to meet the post-Brexit rules, but is now unable to do so.

($1 = 0.7923 pounds)

(Writing by Kate Holton and Sarah Young; Additional reporting by Gokul Pisharody in Bengaluru and Giulio Piovaccari in Italy; Editing by Richard Chang, Jason Neely and Catherine Evans)