Swedish core inflation slowed less than expected in May as Beyoncé fans flooding Stockholm may have driven an increase in hotel prices.

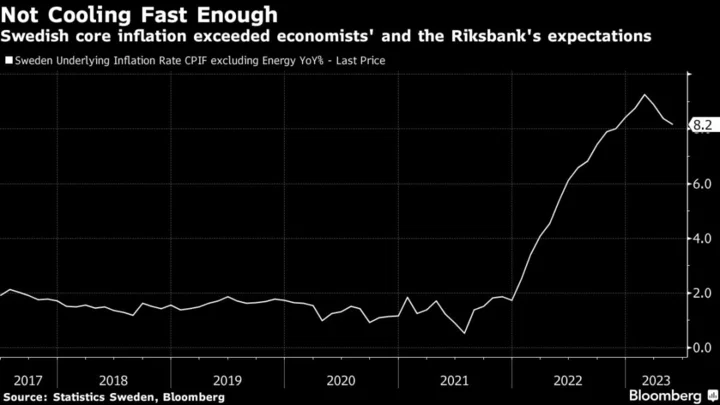

A price measure that strips out energy costs and the effect of interest-rate changes rose 8.2% from a year earlier, according to data published by Statistics Sweden on Wednesday. That was higher than the median estimate of 7.8% in a Bloomberg survey as well as the 8.1% expected by the Riksbank.

Some of the increase could be explained by the world premiere of Beyoncé’s current world tour, according to Danske Bank economists. The US R&B superstar drew more than 80,000 over two nights to Stockholm’s Friends Arena, and visitors likely contributed to an unexpectedly large increase in hotel and recreation prices, the lender’s chief economist Michael Grahn said.

“We expect this upside surprise to be reversed in June as prices on hotels and tickets reverse back to normal,” Grahn said. Danske still expects the Riksbank to raise rates further as the Swedish currency remains weak and inflation hasn’t slowed as much as the central bank would have liked to see.

Glenn Nielsen, an economist at Swedbank, said that while the gigs may have contributed to push accommodation costs higher in May, the surprisingly strong price increases were “fairly broad-based,” and that strong demand in general, as well as high cost pressures, give hotels both the ability and the motivation to raise prices.

The reading comes as price pressures are subsiding globally, with data published Tuesday showing that US inflation slowed to its lowest level since March 2021, while consumer prices in the euro zone rose less than expected in May.

However, Swedish prices are still rising far faster than the central bank’s target, and the weakness of the Swedish currency complicates the situation for the Riksbank as its efforts are hampered by higher costs of imported goods, mirroring developments in neighboring Norway.

The krona has recently been trading near all-time lows against the euro. That development makes it more urgent for the Riksbank to keep its benchmark rate at a higher level than the European Central Bank, which is widely expected to raise its deposit rate to 3.5% on Thursday. It would bring the ECB rate on par with that of the Riksbank, which has said it expects to hike again later this month or in September.

Most economists have penciled in that the Riksbank will announce a quarter-point rate hike on June 29, and the latest price data seemed to confirm that view, regardless of any temporary Beyonce blip.

“All in all, May inflation numbers were a disappointment and came out clearly higher than we had expected,” Nordea’s Torbjorn Isaksson said. “It is a high outcome, not least considering the broad upturn, reinforcing the view that the Riksbank will hike rates in June.”

(Updates with comments from SEB economist in fifth paragraph.)