For the most part of this year, betting against the rupee has been a fool’s errand. Traders are now contemplating one key question: why is the Reserve Bank of India steadfastly defending the currency?

Volatility in the rupee is hovering near the lowest in almost two decades and the currency has managed to avoid breaching a record low even as rising US rates wreaked havoc in emerging markets. India’s central bank has denied defending any levels but analysts have an array of theories as to what is going on in policymakers’ minds.

Abrdn Plc reasons that the RBI is probably tapping its large foreign-reserve stockpile to defend its currency to keep imported inflation in check. Robeco Group says the monetary authority may have intervened to curb moves that it deemed were driven more by sentiment than fundamentals.

“For India, it makes sense,” said Kenneth Akintewe, head of Asian sovereign debt at Abrdn Asia Ltd. “Why build up one of the world’s largest reserves if you are not going to use them? We are also in a world of elevated oil prices among other commodities and undue depreciation will lead to imported inflation which will make it harder to get back to the 4% target.”

As rising US yields continue to exert pressure on developing-nation assets, the RBI has to engage in a balancing act: a stable rupee is more attractive to foreign investors who fear depreciation will hurt returns but a drop in volatility may breed complacency among importers by making them less likely to hedge.

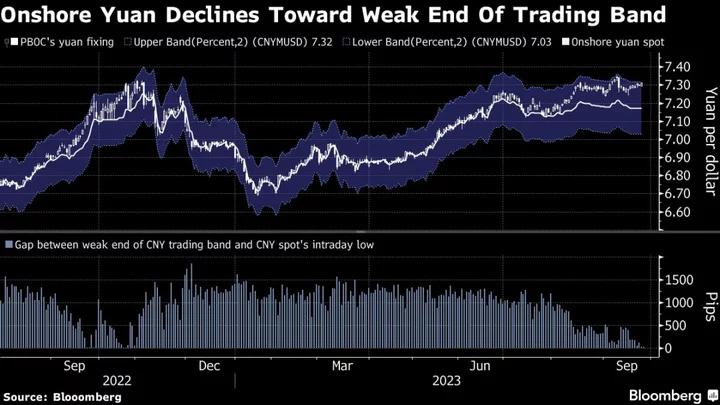

To be clear, the RBI is not the only central bank that’s stepped in to defend its currency from the onslaught of a surging dollar. Authorities in China, Thailand and Japan have also acted but the RBI’s intervention is noteworthy as its reserves have dropped by about $17 billion in the past two months — a decline that analysts say was partly due to dollar sales to support the rupee.

The RBI has shed little light on its thinking about foreign-exchange moves. Last week, Governor Shaktikanta Das said at a post monetary policy press briefing that the central bank didn’t act to defend a particular level for the rupee and only intervened to prevent excess volatility.

The rupee has withstood the strong dollar better than most of its Asian peers this year, confounding traders who started the year by betting that it would remain on the backfoot. The currency has traded close to the record low of 83.29 per dollar for most of 2023 but never weakened past that level.

“The only possible reason is to keep INR anchored with their invisible hand, ensuring less market speculations and anti-INR trade positioning, in case the tide gets difficult globally,” said Madhavi Arora, lead economist at Emkay Global Financial Services.

RBI’s defense of the rupee may have been boosted on two fronts: global funds have pumped more than $14 billion into domestic equities since the start of the year, helping to shore up the currency. Additionally, analysts expect India to attract over $40 billion of inflows over time following its inclusion in JPMorgan Chase & Co.’s bond index.

Others say a recent bond-sale plan announced by the RBI to mop up extra cash was also aimed at supporting the rupee by jacking up yields to preserve the interest-rate gap with the US.

“The global conditions are extremely volatile and uncertain because of which the pressure on the rupee is effectively very high,” said Upasna Bhardwaj, senior economist at Kotak Mahindra Bank. “So at this point, they rather keep any speculative attacks off the curve and they would try to keep the shorter end of the curve much higher to avert any additional or incremental speculative depreciation bias on the INR.”

Some warn that the central bank may not be able to stand its ground for long.

“The fundamentals aren’t favorable to holding a line,” said Philip McNicholas, Asia sovereign strategist at Robeco Group in Singapore. “As the short-term external debt cover is thinner than many think and the current-account dynamics are biased for widening, so the funding need will rise.”