The commercial landlord at the center of Sweden’s property crunch has entered into talks with a large group of bond investors in an effort to shore up its finances.

SBB, as Samhallsbyggnadsbolaget i Norden AB is more commonly known, said it was seeking to strengthening liquidity and had started several parallel processes including the possibility of obtaining capital from the stock market.

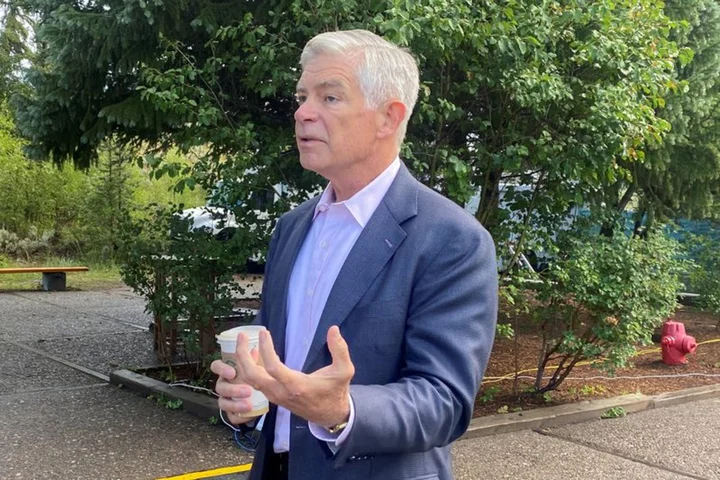

“Creditors, shareholders and employees are all currently working towards the same objective – safeguarding value for all stakeholders,” said newly installed Chief Executive Officer Leiv Synnes in the report for the second quarter.

The Stockholm-based company reported a net loss for the period of 9.9 billion kronor ($970 million), due to revaluations. The figure was significantly higher than analyst estimates of a 2.88 billion kronor loss. Rental income fell 7% from a year ago to 1.75 billion kronor, slightly ahead of the 1.74 billion kronor average estimate of analysts surveyed by Bloomberg.

SBB has seen its share price plunge more than 90% since hitting a peak in late 2021 amid intensifying pressure to get its finances under control. The company, which borrowed heavily in the era of cheap money, has found its $8 billion debt pile increasingly unsustainable amid sharply rising interests and falling property valuations.

The company’s situation worsened in early May after its credit rating was downgraded to junk status by S&P Global Ratings. Since then, SBB has postponed a dividend, ousted its founder Ilija Batljan as chief executive officer and put up the whole firm as well as individual assets up for sale.

SBB’s struggles are part of the broader turmoil in real estate markets, as higher interest rates depress valuations around the world. Its troubles also risk becoming a broader issue in Sweden as the company owns many public-sector buildings like nursing homes and schools.

Read More: Why a Crisis Is Looming in Commercial Real Estate: QuickTake

Tasked with rolling over $1.6 billion of maturing bonds over the next three years, SBB is racing to find buyers for properties as well as raising fresh capital. On Thursday, the company said it signed a letter of intent to sell properties worth more than 3 billion Swedish kronor to existing tenants.

--With assistance from Anton Wilen.