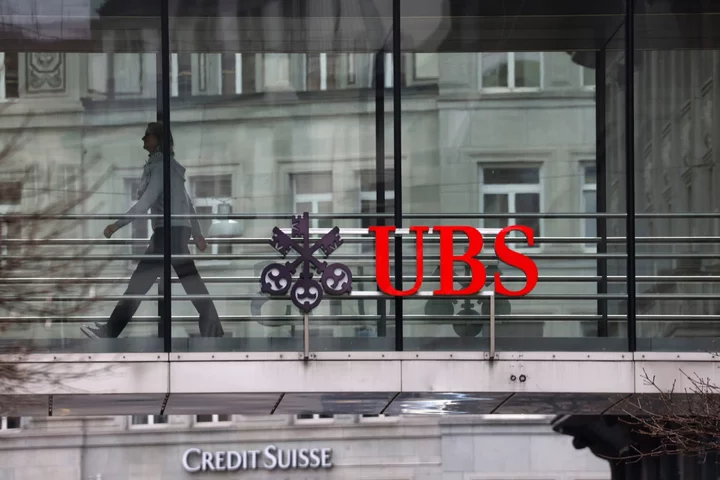

UBS Group AG isn’t planning to take Credit Suisse’s domestic unit public, according to a report Saturday in Schweiz am Wochenende.

UBS CEO Sergio Ermotti opposes the option because he believes it may inadvertently strengthen the bank’s international competitors, the Swiss newspaper said, citing people familiar with the matter who it didn’t identify.

After UBS agreed in March to buy Credit Suisse in an emergency government-brokered rescue, Swiss politicians urged UBS to split off Credit Suisse’s domestic branch and list it on the Swiss stock exchange as a means to preserve jobs, increase competition and limit the risk of broader contagion if UBS were to fail.

The domestic unit’s fate has been widely watched as Swiss-based companies and politicians voice concerns over the market power that the combined bank may exercise.

Read more: UBS Preparing to Cut Over Half of Credit Suisse Workforce

A UBS spokesman didn’t immediately respond to a request for comment from Bloomberg News.

It’s possible Ermotti may still consider spinning off a combination of the UBS and Credit Suisse domestic banks, under the name UBS Switzerland, as long as UBS retains a majority stake, according to the newspaper. Such a scenario would allow a double shareholding structure and may appease concerns about the bank being too big to fail.

Read more: UBS Chairman’s Top-Secret Prep Paid Off in Credit Suisse Moment

Ermotti previously said that all options were on the table and that the “base case scenario” is for UBS to retain Credit Suisse’s domestic unit.

--With assistance from Marion Halftermeyer.