In London, climate change is increasingly reflected in how much it costs to buy or rent real estate.

Office space in the UK capital that’s classified as “green” by virtue of a sustainability certification commands a 20% premium over buildings without such labels, according to data compiled by property broker Jones Lang LaSalle Inc.

Richard Manley, chief sustainability officer at CPP Investments, the $570 billion investment arm of the Canada Pension Plan, says these price differentials are a sign that the corporate push to eliminate greenhouse gas emissions will soon feed into other asset prices that impact investor portfolios.

“We’re starting to see now how decarbonization translates into valuation,” Manley said. CPP has about $50 billion invested in real estate from Brazil to China, including some green buildings.

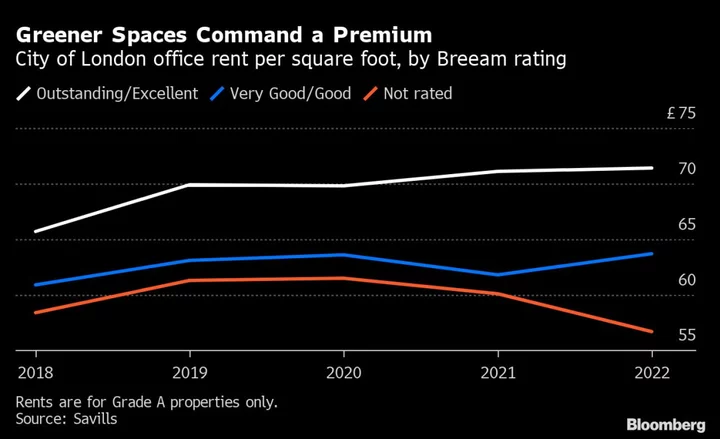

Values for London office buildings with a BREEAM certification, which assesses energy and water use, pollution and waste, were on average 20.6% higher than those without that accreditation, and rents were on average 11.6% higher, according to JLL. That’s based on a study of 592 office investments made during the five-year period ended December 2021. (Data from property adviser Savills Plc show a similar bifurcation between green and non-green buildings).

It’s all about demand. The green premium is the direct product of corporate efforts to cut emissions, Manley said. London is dominated by companies in services industries such as banking, asset management and law firms—and many of these companies have made public commitments to reduce their carbon emissions.

“The easiest lever to play with today is a green building,” Manley said. The result is “we’re seeing a structural shift in demand” for environmentally-friendly properties, he said.

Still, there is a limited supply of green offices in London. Only about 3,000 of the current stock fall into this category, according to Knight Frank. That means the green premium is strong today.

Over time, as more buildings transition to cleaner operating sources, the green premium will likely be replaced with a “grey discount,” Manley said. In other words, instead of rewarding the most sustainable buildings, the market will start to punish those with the worst environmental credentials.

“I don’t think the market has fully quantified and reflected in valuation the contingent liability associated with decarbonization,” he said. “We need to develop a greater appreciation of the actual cost of decarbonization and see how that translates into valuation.”

And Manley is clear that these trends will play out in most other industries, too. This isn’t a real estate story per se; it’s about how businesses and business models will need to adapt for a carbon-constrained world, he said.

Still, real estate is a good place to start since buildings are responsible for roughly 40% of global energy related carbon emissions.

Even with this looming probability of a re-rating of businesses and securities for carbon, most assets are still evaluated on “business-as-usual cash-flow projections,” Manley says. This will have to change, he says, because as investors digest the costs of decarbonizing a company, they will start to question the stability of those cash flows given the increased capital expenditures required to transform the company for a lower-carbon future.

And as investors rethink corporate valuations, the companies themselves will have to give thought to how they can thrive in the new world.

“How do I go from the laggard, maybe at risk of losing access to finance, to a leader more likely to preserve better access” to financing over the next decade, Manley asks. “I think that will be the dynamic by which we start to see this translate into pricing and also translate into the underwriting assumptions and into active management.”

Sustainable finance in brief

ESG investing passed a milestone this week as the first ever set of global reporting standards was unveiled, paving the way for companies across jurisdictions to disclose uniform climate and sustainability information. The voluntary framework, published by the International Sustainability Standards Board, is intended to reshape ESG reporting norms in much the same way as the International Financial Reporting Standards did two decades ago. The ISSB framework will also affect the information companies include in their financial reports, so that these better reflect environmental, social and governance risks.

- Goldman Sachs Group Inc. joined a list of brokers turning less bullish on Tesla Inc. shares after the electric-vehicle maker’s blistering rally this year.

- The Republican backlash against ESG investing has presented the industry with an opportunity to reinvent itself. At least that’s the view of several ESG supporters at a sustainable-investing conference in Boston.

- But investors in the UK are starting to worry that the GOP’s anti-ESG movement may get a foothold on its side of the Atlantic.