The head-scratching rally in VinFast Auto Ltd. shares came to a sudden halt on Tuesday, erasing $83 billion of market value.

The unprofitable and thinly traded maker of electric cars tumbled 44% in New York, snapping a six-day winning streak. It had been rising faster than any other large-cap stock worldwide, jumping 688% from its debut in a SPAC listing on Aug. 15 through Monday’s close.

Despite the wipeout, VinFast’s nearly $107 billion market capitalization still makes it larger than companies like BlackRock Inc. and FedEx Corp.

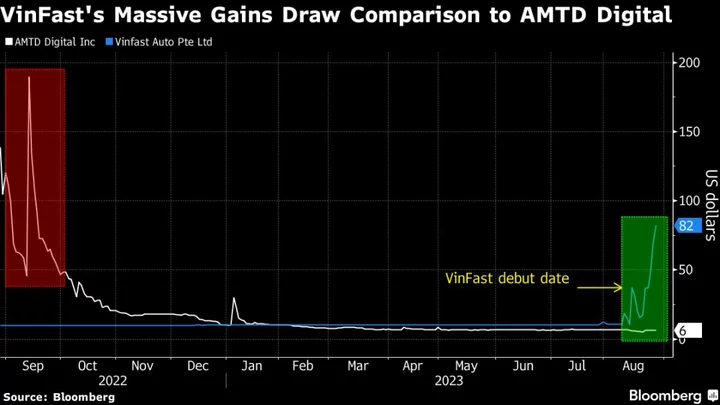

The last time a stock with a tiny free float rose from relative obscurity to the ranks of the world’s largest companies, it didn’t end well for investors. AMTD Digital Inc., another US-listed company with roots in Asia, baffled market veterans a year ago by soaring more than 32,000% in the span of a few weeks. The money-losing financial services company’s paper value at one point reached over $400 billion, exceeding that of JPMorgan Chase & Co.

AMTD has since tumbled more than 99%, hitting a record low last week. Its valuation now stands at a humble $1.1 billion.

While VinFast and AMTD differ in key respects, their tiny free floats and appeal to momentum-chasing retail investors have made both vulnerable to extreme booms and busts.

“VinFast’s current valuations are unsustainable,” said David Blennerhassett, an analyst who publishes on the Smartkarma platform. “And because there are so few VinFast shares available, anyone who buys, say 50,000 shares, will move the stock.”

The wild ride has raised eyebrows across Wall Street, but supporters of VinFast have a case to make.

It’s one of Vietnam’s most high-profile companies, backed by the country’s wealthiest man Pham Nhat Vuong — who has established Vingroup JSC, a conglomerate spanning homes, hotels, hospitals and shopping malls. The group, together with its affiliates and lenders, have deployed $8.2 billion to fund VinFast’s operating expenses and capital expenditures the last six years.

That sets it apart somewhat from AMTD, a Hong Kong-based financial services firm that’s little-known even in its home market.

And because VinFast is hard to short, its rally could revive if buyers step back in. Less than 1% of its shares are available for trading, making it expensive for short sellers to borrow.

Loss Making

Still, VinFast’s surge is hard to justify on fundamentals alone. The automaker sold just 24,000 cars globally in 2022, a tiny fraction of the deliveries made by Volkswagen AG and Ford Motor Co. Its net loss reached nearly $600 million in the first quarter of this year and is expected to widen in the near term as the EV maker scales vehicle production.

Whether or not Tuesday marks the end of the rally, it’s a reminder of the risks in thinly traded stocks that US regulators and exchanges highlighted in the wake of turbulent new listings including AMTD. Nasdaq Inc. said it’s stepping up scrutiny of initial public offerings by small-cap companies, Bloomberg reported in September. Securities and Exchange Commission Chair Gary Gensler said last year that the agency is well-positioned to delve into the causes of unusual moves.

“There are similarities between the meteoric rise of VinFast and AMTD Digital given their small free float and meme stock angle,” said Ken Shih, head of wealth management for Greater China at Saxo Markets. “Investors should be careful of the price volatility.”

--With assistance from Esha Dey.

(Adds details on move throughout.)