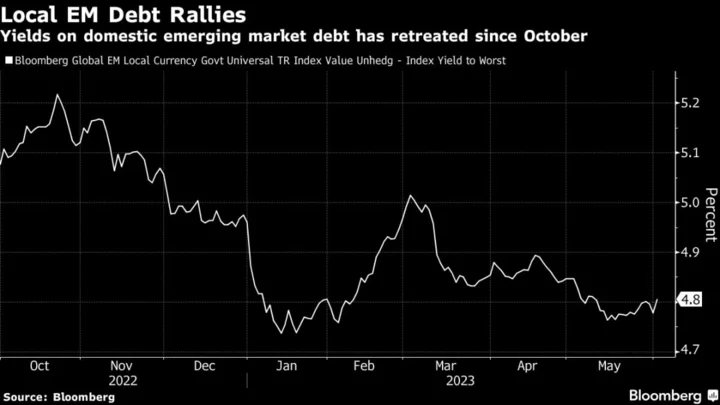

Wall Street is caught by surprise by a rally in local emerging-market debt, an asset class that’s been largely abandoned by foreign investors after a decade of underperformance.

Domestic-currency bonds are this year’s developing-world winners, handing money managers far stronger returns than hard-currency debt or equities, according to data compiled by Bloomberg. BlackRock Inc. has started calling local notes an attractive bet, while strategists from JPMorgan Chase & Co. lauded them as the “star” fixed-income segment of 2023.

So far this year, domestic bonds from Colombia, Hungary, Brazil, Mexico, Peru and Poland have given double-digit returns to holders — many of whom are local.

Resident investors have taken center stage in recent years as overseas money managers pulled out of riskier bets. Foreign ownership of local debt fell to historic lows in the fourth quarter, capping an exodus that spanned the Covid pandemic, Russia’s invasion of Ukraine and the world’s most-recent interest-rate hiking cycle.

“Clearly, anyone reducing in the fourth quarter of last year should have held on,” said Kieran Curtis, director of investment at abrdn in London. “We knew inflation and monetary policy would be peaking over the longer term and certain key countries have had swings in current accounts from deficits to surpluses.”

Emerging-market local-currency bonds have returned 2.2% this year, compared with a 1.6% advance by EM sovereign dollar debt and a 0.6% gain in developing-country equities, as of June 1.

Non-residents cut their holdings of local Mexican bonds to the lowest in 12 years, according to data from Banco de Mexico. For Brazil, foreign ownership fell to a post-2009 low in August. In Hungary, such holdings dropped to an almost three-year low in October and in Poland they hit a post-financial crisis low in September.

The reduced role of foreigners, and with EM debt funds still struggling to attract clients into local-bond funds this year, has made this fixed-income segment less exposed to finicky hot-money flows.

“Whenever there was a risk-off sentiment globally, foreigners would just dump these local-currency bonds,” said Jitania Kandhari, deputy chief investment officer and head of macroeconomic research for emerging markets at Morgan Stanley Investment Management. “And now, because their ownership is low that vulnerability has reduced. I think that investors are now going to start looking at this asset class more closely.”

Local-currency bonds from countries with high interest rates offer an attractive bet, BlackRock money manager Amer Bisat said, adding the shorter-maturity notes offer an “all-in yield” as bond curves are inverted. Bisat is finding opportunities in countries like Indonesia, Czech Republic, Poland, South Korea and Taiwan, saying that prioritizing higher-quality credits is the now key part of EM investing.

Nevertheless, global investors remain reluctant to buy local debt, which has both currency and credit risk, especially amid weak US economic prospects, JPMorgan strategists Jonny Goulden and Saad Siddiqui wrote.

The segment’s long-term underperfomance has been staggering. Local EM debt has handed only a 12% return over the past decade, while developing-nation sovereign and corporate dollar bonds were at 18.4% and US junk-rated credit at 48%, data compiled by Bloomberg show.

“Ahead of a likely US recession, adding a risky fixed income asset class such as EM local bonds that you have not been much involved with for a decade might be a step too far,” Goulden and Siddiqui wrote.

Currency Tailwinds?

Magdalena Polan, the head of emerging-market macro research at PGIM Fixed Income, said the rally in the segment could be “quickly reversed” as inflation remains sticky in parts of the developing world, dashing some bets for rate cuts over the near-term.

State Street Global Advisors said local currency debt could benefit via the currency channel, seeing plenty of scope for dollar weakening. Currencies of countries whose bonds are in a benchmark EM local debt index may be nearly 10% undervalued versus the dollar, according to the firm.

“There remains plenty of scope for dollar depreciation to continue supporting returns,” said Jason Simpson, a senior fixed income strategist at State Street. “Some investors may feel that the best days of EM are already past. However, history suggests that periods of strong returns can persist.”

What to Watch

- Asia’s week ahead will bring fresh signals on China’s economy. Bloomberg Economics expect to see deeper factory-gate deflation, an anemic CPI reading, stalling export growth and — most worrying of all — slack private demand for credit.

- In Brazil, traders will watch the May inflation print for any clues on the path ahead for the nation’s central bank.

- Mexico will also report its latest inflation data, which is expected to show further decline in year-on-year growth. Policymakers there have said the country will need a prolonged stretch of tight monetary policy to get price growth under control.

- Poland’s central bank is expected to hold its key rate unchanged at 6.75%. Investors are focused on whether policymakers will signal that a rate-cut is on the cards this year after an unexpectedly steep drop in inflation.

- Turkey’s headline inflation is expected to dip below 40% for the first time since 2021. Still, it’s unclear whether a downward trend can hold given government polices and expectations of further lira weakness.

--With assistance from Maria Elena Vizcaino and Marton Kasnyik.