Major Ukrainian farm companies are curbing winter crop plantings after Russia blocked the main Black Sea export route, hitting world food supplies for the next two years.

The options for farmers who made Ukraine a global breadbasket are narrowing as the economics of their business deteriorates. They have limited storage space as this year’s harvest piles up, while an alternative shipping corridor along the Danube is expensive and lacks capacity. Grain ports on the river are also being attacked by Kremlin drones.

Decisions taken over the next few weeks in Ukraine — for wheat, barley and rapeseed — will have repercussions for the 2024 harvest. That will hit both Kyiv’s precious wartime revenues, and global supplies of key food staples.

“With grains it’s a full disaster,” said Roman Slaston, head of the Ukraine agribusiness club. “We definitely might see a decrease of winter wheat and barley and winter rye as well.”

Ukrainian agribusinesses IMC and HarvEast are already cutting back on wheat plantings, with the former planning to grow almost one third less. IMC also won’t plant winter rapeseed, said Chief Executive Officer Alex Lissitsa, while Astarta has cut its plantings of that crop.

“Currently it’s not possible to sell any grains because the prices are below the cost of production,” Lissitsa said.

Traditionally Ukraine shipped grains across the world from its deep Black Sea ports. While Russia initially blocked that route after it invaded last year, a safe-corridor deal brokered by the United Nations and Turkey allowed exports to resume.

After a year of shipments that were repeatedly disrupted by Moscow, Russia exited the deal last month. Since then, the Kremlin has escalated assaults on grain infrastructure in Ukraine, including attacking key Danube ports and firing missiles that damaged equipment at a cargo terminal in the Odesa region.

Read More: Russian Drones Hit Danube Port Key to Ukraine Grain Exports

Ukraine has redirected some crop exports by rail, road and river through its European neighbors, but those volumes are causing tensions. Poland, Slovakia and Hungary, along with Bulgaria and Romania, have banned purchases of Ukrainian grain after declining prices spurred protests from local farmers.

So far, the exact impact on the winter planting area for wheat, barley and rapeseed is unclear as rains are delaying harvesting of the previous crop. August and September are a key period for Ukraine’s winter-crop plantings. Fields will lie dormant during the coldest months, before restarting growth in the spring.

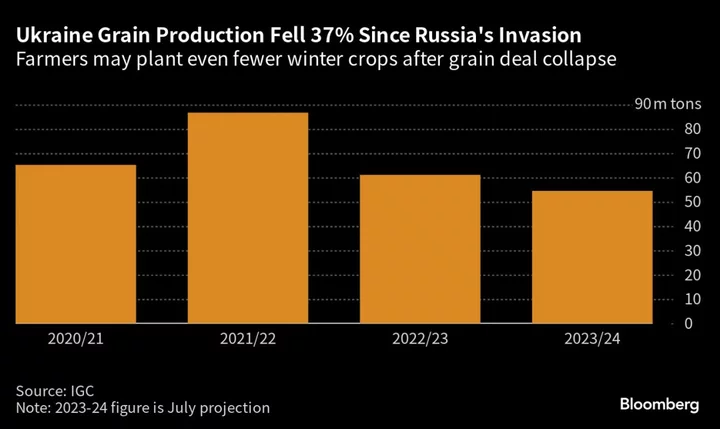

The country’s total grain production has already fallen 37% this year compared with pre-war levels, according to the International Grains Council. The war has also deprived Ukraine of land and disrupted fieldwork as farmers face the task of clearing bombs and mines.

Now the shutdown of the Black Sea corridor threatens to keep wheat supply tighter through the end of 2024.

Crops are piling up in silo bags in the fields as there’s nowhere to store them, according to IMC’s Lissitsa. The Russian attacks on Ukrainian river ports are compounding Ukraine’s problems as vessel owners become wary of operating there.

“We just store it in the hope that we can sell it later,” he said. “Everybody is trying to export via the Danube, but there are limits.”

HarvEast, which lost significant chunks of its land to Vladimir Putin’s invasion, said it was withdrawing about 10% to 15% of its least productive acreage from cultivation.

“With the current prices for agricultural products, considering the problems with logistics for Ukrainian farmers, and given the amount of crop we get from low-productive land, it will be impossible to make profit on it,” CEO Dmitry Skornyakov said.

In the Kyiv region, the company plans to sow only half as much winter wheat as last season.

One alternative, suggested by Lithuania, is to use Baltic Sea ports for the transit of Ukraine’s agricultural exports. However, that could double shipping costs from the Ukrainian border, given the additional distance to those terminals. The European Union is considering subsidizing those costs.

As with this season, the main beneficiary of the challenges facing Ukraine’s wheat farmers through 2024 will be Russia, said Hélène Duflot, a grain-market analyst at Strategie Grains. That situation will be reinforced by weather and acreage issues facing other key grain exporters Canada, Australia and Argentina, she said.

“All in all the global supply is concentrated in Russia again,” Duflot said. “Russia will be a price-maker in the market.”

--With assistance from Megan Durisin and Volodymyr Verbyany.

Author: Áine Quinn