Over the last few years, an ecosystem of climate pledges, groups and models has expanded on Wall Street in a bid to cut—or appear to cut—the financial industry’s role in global warming.

But many of those efforts have had a limited impact on thwarting the damage inflicted by climate change, according to researchers at Columbia University. And at the same time, Wall Street spends hundreds of millions of dollars each year to block measures that could help.

In a 59-page analysis of US banks and money managers published on Friday, the researchers said the range of metrics, calculations and targets they employ can be confusing and misleading, and “may not be fit for purpose.” And the focus on reducing carbon footprints by selling high-polluting assets or using carbon offsets doesn’t mean greenhouse gas emissions are actually being cut in the real world, said Lisa Sachs, director of Columbia’s sustainable investment group, which led the research.

“It’s woefully short of what is needed,” she said in an interview.

For Wall Street to have a much greater impact on climate change, it should stop supporting lobbyists and special interest groups that stymie regulation, according to the report. Finance firms should be pushing for things like carbon pricing, public financing and regulations, the researchers said.

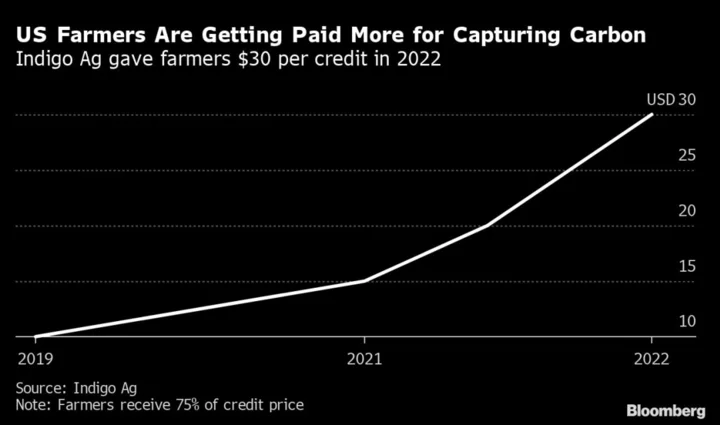

Almost $200 trillion of investment is needed by 2050 to reach net-zero emissions, researchers at BloombergNEF estimate. Under pressure from environmentalists and investors, Wall Street has developed ways to ostensibly measure its carbon footprint and joined groups pledging emissions cuts. Climate activists say those efforts fall short of addressing climate change, while Republicans (often on behalf of fossil fuel giants) have attacked them for allegedly going too far.

Banks and investment firms, the Columbia researchers say, often confuse and conflate reducing their own financial risks to climate change with taking actions that actually reduce global warming. The industry needs to explain its climate measures more accurately.

One example the researchers gave is the Glasgow Financial Alliance for Net Zero, known as GFANZ. The coalition said in November 2021 that its hundreds of member firms, with combined assets of roughly $130 trillion, are committed to accelerating the decarbonization of the global economy.

“Of the assets controlled by member institutions, few were in any way redirected, leveraged, or otherwise used to advance climate action,” the researchers wrote in their report. A spokeswoman for GFANZ said the alliance can’t comment on a report it hasn’t seen. (GFANZ is co-chaired by Michael R. Bloomberg, the founder and majority owner of Bloomberg News parent Bloomberg LP.)

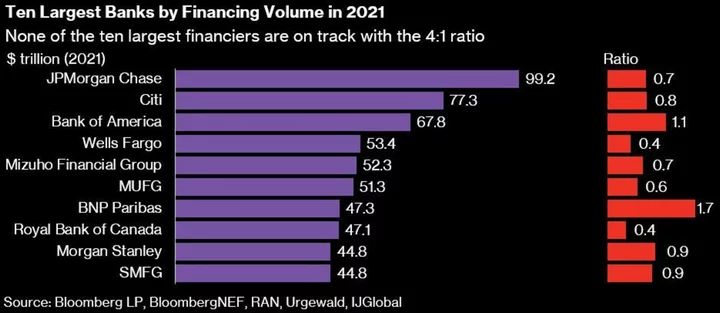

Moreover, much of the climate work done by financial firms only covers a limited set of their assets, and so they need to make clear how much of their financing or investing is actually covered by their climate measures, according to the Columbia report.

The researchers said investors’ efforts to sell high-polluting assets in a move to decarbonize their investments have little impact on cutting overall emissions, because those assets are just merely sold to other investors. In addition, divesting small amounts of shares in polluters doesn’t penalize the companies by raising their financing costs, the researchers said, citing an academic study.

The Columbia report criticized banks’ continuing efforts to calculate emissions associated with their financing. So-called financed emissions are plagued by different methodologies which make it difficult to compare data. Measurements can also be warped by things like inflation or recessions, resulting in inconsistent results, the report said.

The financial industry needs to reduce its use of carbon offsets while enacting both short- and long-term goals to cut emissions, the researchers said. Companies should also use targets to cut absolute emissions—or a set amount—rather than emissions per unit of revenue or output. And finally, they should separate more potent methane emissions from other greenhouse gases in their calculations.

But perhaps most importantly, the researchers said, if the financial industry is to help in the fight to slow global warming, it must stop actively working to make it worse.

Financial firms must stop lobbying against climate action and require their clients and the companies they invest in to do the same, the researchers said. The industry spent more than $663 million on lobbying last year, while political payments to members of Congress during the 2022 election cycle totaled $303 million, the report said, citing data from the Open Secrets website.

“Finance needs to stop blocking and start supporting robust climate policies,” Sachs said.