The VIX is at 20, stocks are on the brink of their worst October in five years, and every other day the bond market throws a fit.

For equity bulls conditioned to dive in at any sign of weakness, it’s getting to be too much. Across investor categories, they’re pulling money out and hardening a posture that is by some measures the most defensive in over a year.

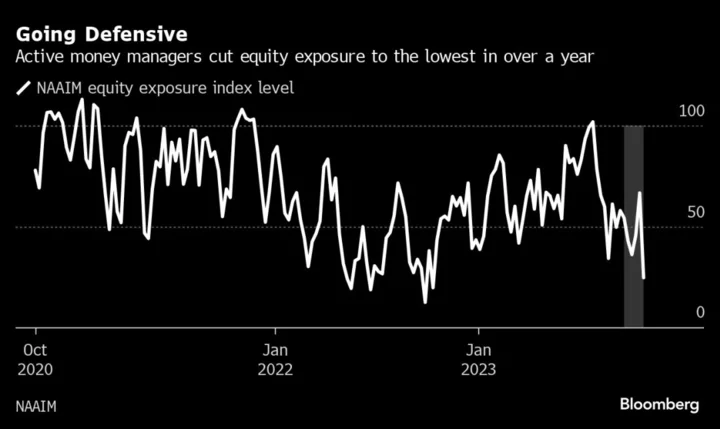

Surveys of professional managers show big-money allocators have cut their equities to levels last seen at the depths of the 2022 bear market. Hedge funds just pushed up single-stock shorts for an 11th straight week. Models of investor positioning show everyone from mutual funds to systematic quants reducing equity exposure well below long-term averages.

Among trading sins, few are as unanimously pilloried as market timing, but that doesn’t keep it from happening in times of stress. Whether the latest exodus is the precursor to a rebound or a protracted period of pain is the big question heading into November.

“It’s troubling that a market setback as internally deep as the current one hasn’t resulted in more improvement” in sentiment, said Doug Ramsey, chief investment officer at the Leuthold Group. “The ‘wall of worry’ accompanying much of the 2023 market action has morphed into a ‘slope of hope.”’

Dip buyers are hard to find, with the S&P 500 falling more than 1% five different times in October and pushing the index into a correction on Friday. A gauge of projected price swings in the Nasdaq 100 Index hovers near the highest level since March. Even after tech finally caught a break Friday on solid earnings from Amazon.com Inc. and Intel Corp., the Nasdaq 100 closed out the worst two-week drop this year and is poised for its steepest October loss since 2018.

A poll by the National Association of Active Investment Managers shows money managers rolling back in exposures to October 2022 levels. Equity positioning has fallen below long-term averages for most investor categories, particularly hedge funds and mutual funds, according to Barclays Plc analysis of CFTC data. A nearly three-month ramping of short positions by professional speculators is the longest increase in the history of data, says Goldman Sachs Group Inc.’s prime brokerage.

Wall Street’s “fear gauge,” the Cboe Volatility Index, held above 20 for a second consecutive week after staying below the threshold more than 100 days. Bond volatility gave investors more reason to worry as gyrations of more than 10 basis points on Wednesday and Thursday put further pressure on an earnings season where companies that miss estimates are getting whacked.

“With yields much higher than they were six months ago, the stock market is going to have to fall to valuation levels that are more in line with historical levels,” said Matt Maley, chief market strategist at Miller Tabak & Co. “The most important issue is the very large divergence that has developed between the bond market and the stock market.”

From a contrarian standpoint, all the gloom is a positive, suggesting latent buying power should sentiment ever flip. Several strategists see that happening. Big reversal in equities last year were closely correlated with changes in institutional and retail positioning. Gains came after investors slashed bullish bets, and declines occurred after buying sprees.

Strategists at Barclays said lower exposure to stocks, bullish technical signals and seasonality are raising the odds of a year-end rally. It’s a message that was echoed earlier at Bank of America Corp. and Deutsche Bank AG.

“Fear is uncomfortable, but it’s a healthy dynamic in markets,” said Callie Cox at eToro. “If investors are braced for the worst, they’re less likely to sell all at once if bad headlines do pop up.”

Predicting market inflection points is impossible, of course. With investors digesting the Fed’s higher-for-longer message and key inflation metrics still showing signs of life, negative sentiment may prove justified. With the Fed shrinking its portfolio of government securities at a rapid pace, it puts pressure on investors looking for clues of how high can yields go.

“The higher-for-longer message and recent inflation signs suggest that bonds will not be stabilizing any time soon,” said Peter van Dooijeweert, head of defensive and tactical alpha at Man Group. “Related equity weakness off the rate rise may persist — especially if earnings don’t deliver.”

--With assistance from Lu Wang.