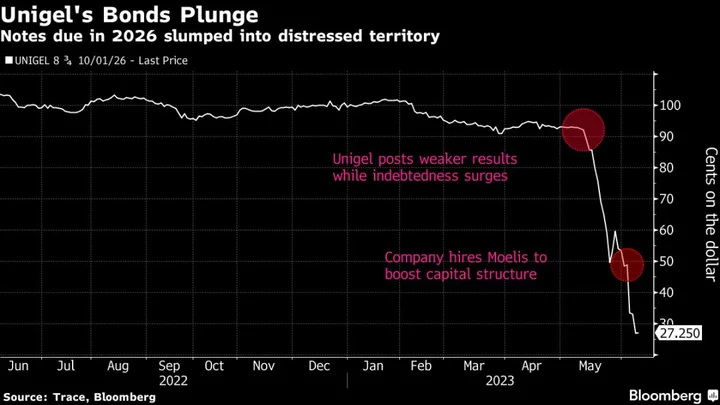

The company whose bonds have handed investors losses of roughly 70% since mid-May, making them the worst performers for the year in emerging markets, could be heading for more pain.

Bonds of Unigel Participacoes fell another 17 cents on the dollar this week, though they posted a gain on Friday afternoon to trade around 32 cents. The Brazilian fertilizer maker said on May 12 that its first-quarter earnings had plummeted. The company is struggling after prices for fertilizers globally dropped amid tepid demand from farmers and declining prices for gas — the main input for most nitrogen fertilizer.

If its income keeps dropping, the company could be in violation of its borrowing agreements for local debt, potentially forcing it to repay obligations in short order, according to its bond-lending agreements. The manufacturer, owned by the billionaire Slezynger family, said on Monday that it had hired investment bank Moelis & Co. to help navigate the situation.

The hiring was “somewhat unexpected at this stage,” wrote Sebastian Hofmeister, a senior credit analyst at Lucror Analytics, in a note. The move “suggests that Unigel is preparing for an out-of-court debt restructuring.”

A representative for Unigel declined to comment.

It’s a rapid turn in fortunes for a company that in January was talking about investing close to half a billion dollars to become a top global supplier of green hydrogen, a carbon-free fuel. The company had considered an initial public offering as recently as 2021, and in January an official said the company remained ready for one.

Unigel was founded by Henri Slezynger, whose family fortune is valued at around $1.9 billion, according to calculations by the Bloomberg Billionaires Index. The company is one of the main fertilizer producers in an economy that is 25% agribusiness. It also sells chemicals to industrial customers.

Cash Flow

On May 12, Unigel posted an 82% drop in a key measure of income, its adjusted earnings before interest, tax, depreciation and amortization. The company also said it had 686 million reais ($135 million) of cash at the end of the first quarter. And its $530 million of US dollar notes don’t mature until 2026.

Those figures should give some comfort to investors, Lucror’s Hofmeister wrote. The company appears to have enough liquidity until fertilizer prices recover later this year or in the first half of 2024, he said.

But Fitch Ratings estimates Unigel will need about 740 million reais by the end of 2024 to meet its debt obligations. Unigel reported a total outflow of 225 million reais from its operations for the first quarter, and Fitch expects a negative free cash flow for the year of 800 million reais.

Adding to Unigel’s problems, the lending agreements known as indentures for its local bonds require it to keep the ratio of net debt to adjusted Ebitda below or at 3.5 times. In the first quarter, that figure jumped to 2.2 times, and S&P Global Ratings estimates it could peak at close to 10 times by the end of the year.

Breaching that level would force Unigel to get permission from investors to remain in violation of the requirement under its indentures, known as getting a waiver, or potentially be forced to repay debt sooner than it expected.

“We understand that this is a small group of investors that they need to get the waiver from in the maintenance covenant, but it is still a possibility that they might run into issues there,” Fitch’s Lincoln Webber said in an interview.

On Friday, Fitch downgraded Unigel’s credit to CCC from B, noting that it is “unlikely that Unigel will receive support from its shareholder or sell its assets in a time frame that would support its liquidity.”

Asset Sales?

These worries were enough to push the company bonds down from around 91 cents on the dollar on May 11. The drop of nearly 71% in the bonds is the biggest this year in percentage terms for emerging-market companies.

Unigel could boost liquidity by selling assets, and it’s in talks with Brazil’s state-controlled oil giant Petroleo Brasileiro SA for a potential partnership in some fertilizer projects, according to regulatory filings.

But divestments may also disappoint as trading multiples for the sector are low, said Eduardo Ordonez, a money manager in Copenhagen at BI Asset Management. By the time the petrochemical and agriculture markets rebound, Unigel may still struggle to generate enough cash to repay bondholders, according to him.

“A restructuring of the bonds seems the more likely alternative,” he said.

--With assistance from Daniel Cancel, Mariana Durao and Marina Cavalcante.

(Updates prices in 2nd paragraph, adds Fitch downgrade in 14th paragraph)

Author: Vinícius Andrade and Giovanna Bellotti Azevedo