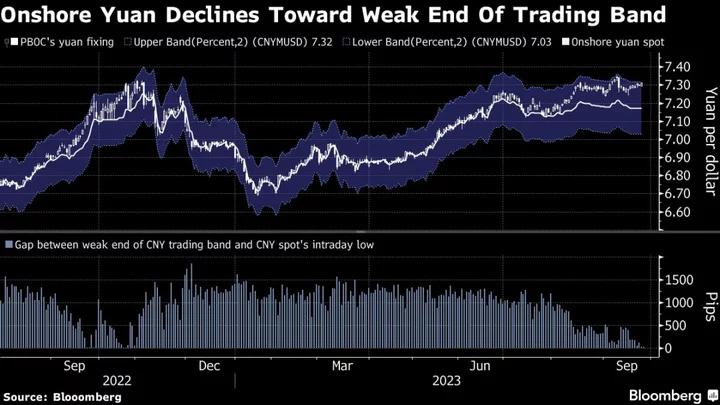

The yuan weakened toward the limit of its fixed trading band against the dollar, as China’s worsening property crisis and a stronger dollar delivered a one-two punch to the embattled currency.

The onshore yuan this week declined to trade more than 1.9% weaker than People’s Bank of China daily reference rate, which limits the currency’s allowed range by 2% on either side. On Monday, it came the closest to the limit of the band since last October.

The return of yuan weakness is a frustrating development for policymakers, who had managed to stabilize the currency less than two weeks ago by boosting the cost of short bets and delivering a strong verbal warning against bears.

To prevent the yuan from hitting the end of the trading limit — at which point liquidity may dry up — the PBOC could choose to weaken the daily fixing, effectively allowing it to catch up with the spot rate. That, however, sends a signal that Beijing is greenlighting depreciation, which could result in even sharper declines and fund capital outflows.

The central bank could also opt to step up its foreign-exchange defense with more aggressive intervention measures — such as engineering a liquidity crunch in Hong Kong or tightening China’s capital controls. That nudges the yuan closer to the fixing without having to cut the latter.

The PBOC “could be concerned about capital outflow risks and implications on financial system stability and market sentiment, especially that China sentiment has remained quite weak,” said Xiaojia Zhi, an economist at Credit Agricole CIB in Hong Kong. “Against dollar strength, the PBOC is really showing a quite tough stance here.”

On Monday, the crisis at China Evergrande Group deepened after the company’s mainland unit said it failed to repay an onshore bond, hurting confidence over yuan-denominated assets and the recovery of the world’s second largest economy. The dollar’s relentless advance on the back of resilient US data and bets on a hawkish Federal Reserve also weighed.

Shrinking Volume

The yuan was little changed around 7.31 per dollar Tuesday morning, compared with the PBOC’s fixing of just over 7.17. The cost to borrow the currency in Hong Kong over the short-term surged to the highest since 2022, raising speculation that China may be mopping up liquidity overseas to support the exchange rate.

A drop in trading volume in the yuan also exaggerated market moves and made it easier for the currency to hit the weak limit. Investors executed less than $10 billion of transactions in yuan versus the dollar in the onshore market on Monday, less than one third of the average volume seen in the past year, according to traders who asked not to be identified.

Despite its weakness versus the greenback, the yuan is stronger versus a basket of 24 currencies tracked by Bloomberg. But that’s largely due to officials’ efforts to prevent it from sliding versus the dollar rather than optimism over Chinese assets.

The wider gap between the yuan’s spot rate and the fixing “reflects the mounting yuan depreciation pressure and the PBOC’s firm stance to defend the yuan,” said Ken Cheung, chief Asia FX strategist at Mizuho Bank. The central bank will continue to use existing tools to support the currency and there’s a chance it may invent new ones, he said.

--With assistance from Qizi Sun.

(Updates throughout)