Zambia will pay interest rates of as low as 1% until 2037 as part of its debt restructuring deal secured with nations including China this week, according to people with knowledge of the matter.

The southern African country will push out maturities on $6.3 billion in bilateral debt to 2043, representing an average extension of more than 12 years. Rates will increase to a maximum 2.5% after 14 years under the baseline scenario, said the people, who asked not to be identified because the details weren’t public. Zambia was paying an average of 3.9% on its Chinese bilateral loans, according to estimates by Debt Justice, a UK organization that campaigns for loan cancellation for poor nations.

The Zambian government announced the landmark deal in Paris this week under the Group of 20’s Common Framework mechanism for traditional creditors of the Paris Club to negotiate deep relief alongside new lenders, especially China. The nation must now get its private creditors to agree to comparable treatment.

Read More: Zambia Wins Debt Relief, Sets Precedent for Stressed Nations

It’s a major breakthrough for a process that had been mired in delays, just as the number of countries needing restructuring expanded. Zambia became Africa’s first pandemic-era sovereign defaulter in November 2020, and has been in talks with its official creditor committee for about a year.

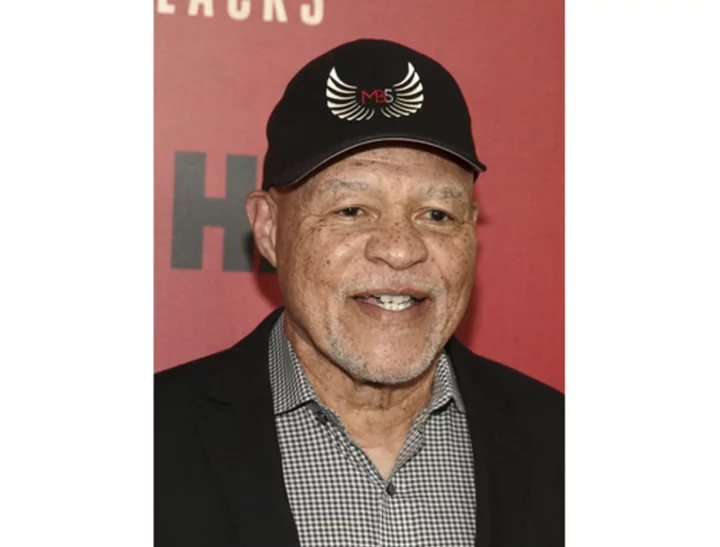

“It was like a mission impossible,” Zambian President Hakainde Hichilema said Saturday to a cheering crowd of hundreds at the airport on his return to Zambia’s capital, Lusaka. “It wasn’t a straight line. It was zig-zag, sideways, forward, backwards, down, up. But we kept our eyes on the ball.”

While the deal doesn’t include debt cancellation, and rather pushes out maturities at much lower interest rates, people including International Monetary Fund Managing Director Kristalina Georgieva welcomed what she described as “deep debt relief.” Chinese lenders resisted writedowns, preferring to extend payment terms.

The Zambian finance ministry couldn’t immediately provide comment when asked to confirm the details. A London-based spokesperson for Lazard Freres, the government’s financial advisers, declined to comment. The Chinese embassy in Lusaka didn’t respond to requests for comment.

The deal includes a contingency for if Zambia’s economy performs better than expected, at which point creditors will get paid more. Zambia said in October it’s seeking to revamp about $12.8 billion in loans out of its total external public liabilities that grew to more than $18 billion by the end of 2022.

Other key terms of the deal, reported here for the first time, include:

- Under the baseline scenario, the reduction to net present value of the debt equals about 40% using a 5% discount factor.

- If Zambia is judged to be upgraded to a “medium” debt carrying capacity, interest rates rise to a maximum 4%.

- Principal repayments are to begin in 2026, at 0.5% or about $30 million yearly, until 2035.

- A loan for the Kafue Gorge Lower hydropower plant will be included in the restructuring, even after China requested it be ring-fenced.

While the IMF put Zambia’s bilateral debt at nearly $8 billion by the end of 2021, the government said it’s restructuring $6.3 billion in official loans. The reason for the difference is that some Chinese debt was reclassified as commercial, the people said. These loans will still get comparable treatment.

Zambia now needs to seek restructuring terms at least as favorable from its commercial creditors, including the holders of $3 billion in eurobonds that are also more than $500 million in arrears.

Hichilema in his speech on Saturday thanked French President Emmanuel Macron and Chinese President Xi Jinping. China and France co-chaired the official creditors’ committee. Zambia’s leader said in an interview on Friday that he plans to visit China within the next three months or so, in what would be his first trip there since winning power in August 2021.

--With assistance from Taonga Mitimingi and Jennifer Zabasajja.