Asian stocks are set to fall in early trading as the rout in US stocks and Treasuries deepened amid geopolitical angst and worries global interest rates will stay elevated for longer.

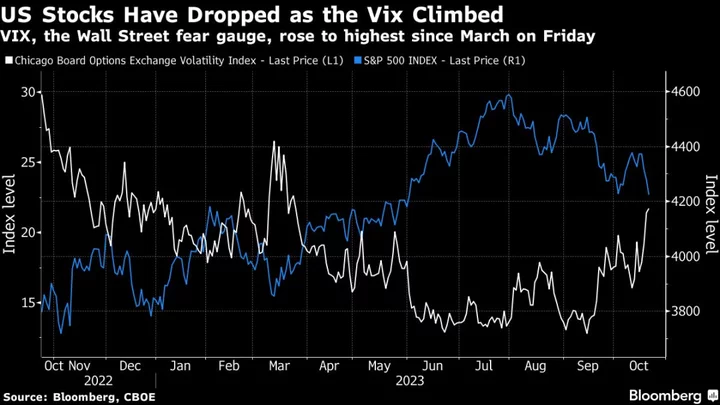

Equity futures in Australia, Japan and China indicate early losses of almost 1%, after the S&P 500 on Friday broke the 200-day moving average — seen by some as a bearish signal — and the VIX, Wall Street’s “fear gauge,” jumped to its highest since March. Oil eased from $90 a barrel.

Traders continued to seek haven assets amid the latest Middle East developments, with gold edging closer to $2,000 an ounce and Treasury yields paring weekly gains that pushed the 10-year rate to almost 5%. While a trickle of aid is getting through to Gaza, the Israeli military has stepped up air raids in preparation for the “next phase” of the war.

The yen quickly retreated from 150 per dollar after breaching the level earlier Monday, a closely watched level for possible intervention by Japanese authorities to support the currency. Bank of Japan officials are pondering the question of whether to tweak the settings of the yield-curve control program at its policy meeting next week, the Nikkei newspaper reported on Sunday, without saying where it obtained the information.

“Markets are again on high alert for a possible BOJ intervention,” Commonwealth Bank of Australia strategists including Joseph Capurso wrote in a note to clients on Monday. The yen is likely to remain under pressure this week as the rise in the 10-year Japanese government bond yield, amid growing speculation of BOJ policy tightening, will do little to reduce Japan’s wide bond yield gap with the US.”

Read: Bond Market’s Bad Tidings Start to Overwhelm Miracle Stock Rally

Aside from the Middle East crisis, global markets have been whipped around in recent weeks by climbing Treasury yields and growing worries about interest rates staying elevated for longer. Federal Reserve Bank of Cleveland President Loretta Mester said the US central bank is close to wrapping up its tightening campaign if the economy evolves as expected.

While the S&P 500’s declines last week appeared largely orderly, the nearest futures contracts tied to the Cboe Volatility Index — also known as the VIX and a measure of expected swings in America’s benchmark equity gauge — closed Thursday in a pattern known as backwardation. It’s a telltale sign of mounting distress, as traders anticipate more volatility in the near-term than further out in the future.

Read: VIX Is in Backwardation! Here’s Why and What It Means: QuickTake

This week, traders will be parsing for clues on the outlook for global interest rates with inflation readings in Australia and Japan as well as economic activity data in the US and Europe. Federal Reserve Chairman Jerome Powell is due to give remarks and the European Central Bank will deliver a policy decision later in the week.

Some of the main moves in markets:

Stocks

- S&P 500 Index fell 1.3% on Friday

- S&P/ASX 200 futures fell 0.9% as at 6:47 am in Tokyo

- Nikkei 225 futures fell 0.7%

- Hang Seng futures fell 0.8%

Currencies

- The Australian dollar was little changed at $0.6319

- The Japanese yen was little changed at 149.87 per dollar

- The offshore yuan was little changed at 7.3275 per dollar

- The euro was little changed at $1.0597

Cryptocurrencies

- Bitcoin fell 0.2% to $29,804.66

- Ether fell 0.2% to $1,638.08

Bonds

- The yield on 10-year Treasuries declined eight basis points to 4.91% on Friday

- Japan’s 10-year yield fell 0.5 basis points to 0.835% on Friday

- Australia’s 10-year yield declined two basis points to 4.72% early Monday

Commodities

- West Texas Intermediate crude fell 0.7% to $88.75 a barrel on Friday

- Spot gold rose 0.4% to $1,981.40 an ounce

This story was produced with the assistance of Bloomberg Automation.