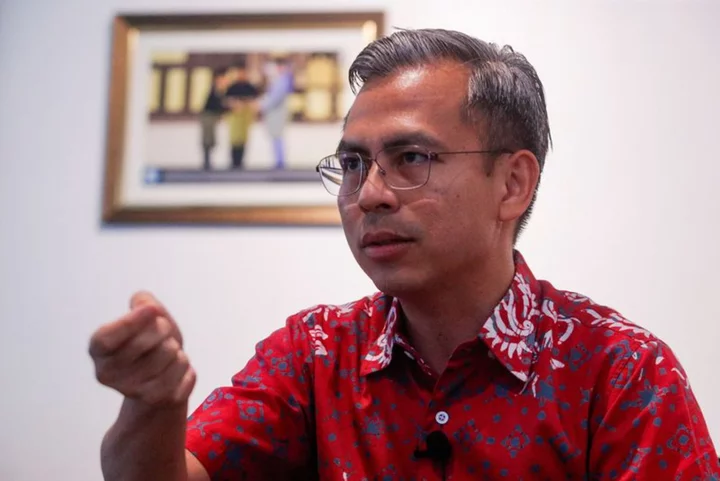

Bank of Japan Governor Kazuo Ueda said price growth remains slower than the central bank’s goal, explaining why officials are continuing with their current monetary-policy strategy.

“We think underlying inflation is still a bit below our target of 2%,” Ueda said Saturday during a panel discussion at the Federal Reserve’s annual symposium in Jackson Hole, Wyoming. “This is why we are sticking with our current monetary easing framework.”

Annual inflation, as measured by consumer prices excluding fresh food, registered 3.1% in July and the rate “is expected to decline toward the end of the year,” Ueda said.

Referring to Japan’s economic growth earlier this year, Ueda said it was “to a certain extent a response to a loosening of pandemic-related restrictions.”

“We think domestic demand is still on a healthy trend, although that’s something that needs to be checked with” third-quarter data, Ueda said.

Ueda didn’t comment on foreign exchange rates during his address, which was part of a panel on globalization.

He spoke a day after Fed Chair Jerome Powell sent the yen down against the dollar by indicating US interest rates are likely to stay elevated and may rise further.

Toward the end of a roughly 20-minute talk, Ueda also called China’s recent economic slowdown a “disappointment,” with July data “on the weak side.”

“The underlying problem appears to be the adjustment in the property sector and the spillover to the rest of the economy,” Ueda said of China.

He cited relative strength in the US economy as providing “some offset” to Japan.

Traders are searching for more clues about the policy path of the world’s last anchor of low interest rates. The BOJ loosened a grip on its yield curve control program last month in Ueda’s first surprise move. He denied it was a step toward normalization.

Most BOJ watchers no longer expect any policy change this year as the governor takes time to monitor inflationary pressure, the weak yen and multi-year highs in bond yields. April has become the most popular month for a policy change forecast in a Bloomberg survey.

A government report Friday showed that inflation in Tokyo slowed below 3% for the first time in almost a year, an outcome that supports the Bank of Japan’s view that price growth will cool.

On globalization, speaking of efforts by the US and other nations to diversify trade away from China and shift manufacturing to allied countries, Ueda said that creates uncertainties for the economy and monetary policy.

In addition, he also said Japan may be at risk of losing out in the global race to attract top companies because it might not have adequate infrastructure.

--With assistance from Michael McKee.

(Updates with comments on economic growth, global trade starting in fourth paragraph.)