European stocks extended gains on Monday, led by cyclical sectors, as signs of cooling US inflation fueled appetite for risk assets.

The Stoxx Europe 600 Index added 0.3% by 8:16 a.m. in London. Miners and energy stocks advanced, while media and health care underperformed.

Among individual stocks, Cellnex Telecom SA rose after the Spanish telecommunications tower operator bought from Iliad SA the stake in a Polish tower portfolio it did not yet own. UK pharmaceuticals giant AstraZeneca Plc fell after a cancer medicine trial raised some safety concerns.

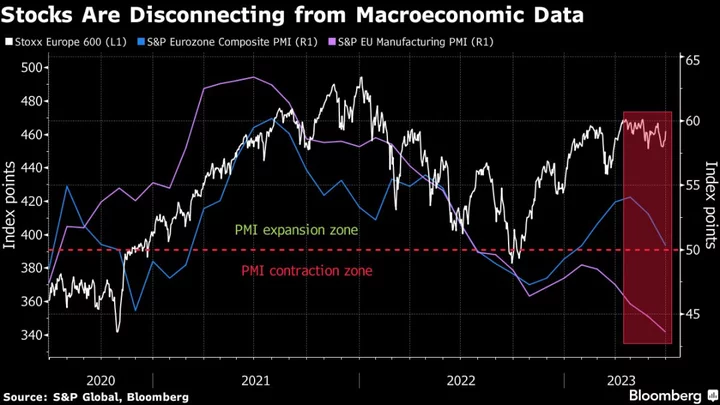

European equities rallied nearly 9% in the first half of the year, fueled by resilient earnings and bets that easing inflation will spur central banks to pause rate hikes. However, some strategists are concerned that recessionary headwinds and stubbornly hawkish monetary policy will put a damper on the second half. Data on Friday showed the Federal Reserve’s preferred measures of US inflation cooled in May and consumer spending stagnated.

“The first half saw a normalization moment from the excess losses that we have seen in 2022,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “We are finally witnessing the expansion of the market participation after six months of very tiny breadth. This is happening because of the continuous improvement of macro data in the US but also because rates are moving up.”

READ: It’s Getting a Lot Harder to Chase the Stock Rally From Here On

Investors will be carefully watching the upcoming earnings season. JPMorgan Chase & Co. strategists said profit resilience will be put to the test in the second half, with corporate pricing power likely to weaken from here.

“The mood as captured by our metrics of long-term investor flows and holdings is skeptical. Investors had been reducing risk in the past the couple of months, especially in cyclical sectors, which suggests a latent concern about the recession which is yet to arrive,” Michael Metcalfe, head of macro strategy at State Street Global Markets, said by email. “With all the PMI data in focus and European growth fears been realized, that fits nicely with the idea that investors are not quite as exuberant as the price action suggests.”

SECTORS IN FOCUS

- European mining stocks are in focus on Monday as iron ore opened the second half of the year on a weak note as traders weighed a seasonal demand slowdown that may be compounded by China’s poor recovery.

- Stocks that are exposed to the tourism industry in France, from travel to leisure and luxury, are in focus as tensions eased overnight after close to a week of riots triggered by a police officer’s fatal shooting of a teenager.

- Shares of electric-vehicle makers are in focus after Tesla and BYD set fresh sales records in the second quarter.

For more on equity markets:

- Don’t Hold Your Breath for a Second-Half Rally: Taking Stock

- M&A Watch Europe: Dufry, Autogrill, Rovio, Cellnex, UBS

- US Stock Futures Little Changed

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.